The Silicon Valley Bank Crisis: 10 Crisis PR Tips for Banks From the SVB Failure

If there is a big news story in banking so far this year, it’s the failure of the 16th largest bank in the United States. Silicon Valley Bank out of Santa Clara, California, failed on March 10, 2023. The SVB collapse, which took place over the course of roughly 48 hours, reverberated through the banking world. It has caused a number of ripple effects over the last week. Despite the good news for depositors from the government, the days and weeks ahead of us are sure to produce a litany of analyses focused on the financial fundamentals of the institution, the impact on the startup community, and the human cost of lost jobs. We believe there is some value in spending a few moments talking about this near tragedy from a communications perspective.

In this edition of Compound Interest, we examine the communication collapse that contributed to the Silicon Valley Bank crisis. More importantly, we share 10 crisis PR tips for banks to follow. Don’t let what happened to SVB doesn’t happen to you.

- What Happened to Silicon Valley Bank?

- The Silicon Valley Bank Crisis Explained

- 10 Crisis PR Tips for Other Banks to Follow

- 1. Know your audience—all of them

- 2. Face the ugly

- 3. Remove the emotion

- 4. Have a message

- 5. Control the message

- 6. Consider the effect of bad news on customer and investor touchpoints

- 7. Do not make major announcements on wire releases without a comprehensive PR plan

- 8. Remember internal comms matter, too

- 9. Mobilize social media

- 10. Don’t say “Don’t panic”

- Get Expert Help With Your PR Crisis Plan

What Happened to Silicon Valley Bank?

This has been extensively covered. However, for background purposes, a simplified explanation of SVB’s situation follows. Flush with money and with low interest rates in 2021, SVB had over-invested in seemingly conservative and safe long bonds. Steep rises in interest rates over the following 18 months caused those investments to lose value. Additionally, scarier economic conditions had bank customers dipping increasingly into their accounts to make payroll. This led to both solvency and liquidity problems. SVB responded by selling assets at a loss and raising capital in an attempt to improve both. (For a deeper dive into the SVB financial situation, we suggest checking out this Forbes analysis.)

A false sense of security?

Until recently, things seemed pretty rosy for SVB. They had happy employees and regularly made appearances on “best places to work” lists. Forbes even named them in the top 20 of the 2022 Best Banks in America. Without a doubt, Silicon Valley Bank was seen as the epicenter of innovation in the world of start-ups and venture capital firms. It was described as a “pillar of the technology industry since its opening in 1983.” In fact, until Wednesday, March 8, our data shows that press hits and sentiment were almost entirely positive or neutral (we see a lot of neutral press hits because of filings online and in print so that’s normal). This includes the Q4 earnings release which painted a fairly positive picture.

The Silicon Valley Bank Crisis Explained

March 8, 2023

4:06 p.m. EST

Six minutes after the NASDAQ ended trading for the day, in a move that was likely not an accident, Silicon Valley Bank sent out a 496-word press release on the wire service. It announced in fairly technical terms the sale of assets at a loss of nearly $2 billion and a capital raise of another $2 billion—with no reason given. No explanation, shareholder call, direct press interaction, or message. No nothing. Understandably, there are limits to what SVB could say in that release. However, it seemed clear to many financial experts that SVB was avoiding having a transparent conversation with customers about their recent moves.

4:30 p.m. EST

Unrelated but hot on the heels of the SVB wire release, California Cryptocurrency Bank Silvergate Capital announced an “orderly wind-down of Bank operations and a voluntary liquidation of the Bank.”

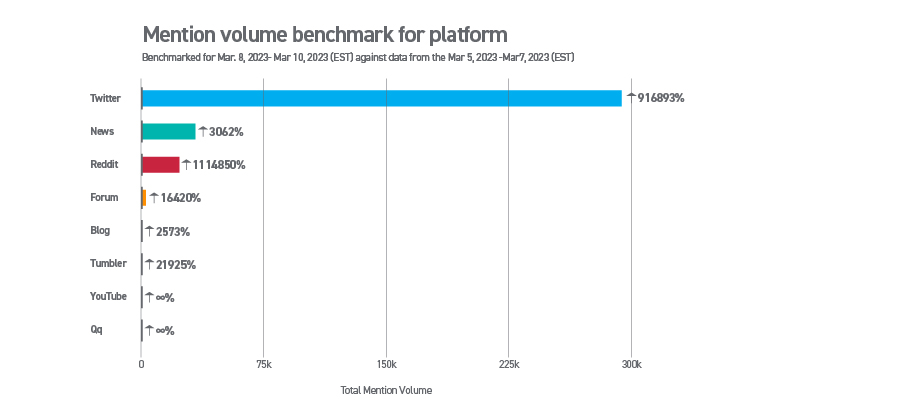

Around this time, social media went ballistic, with Twitter and Reddit threads dominating the conversation about the latest financial news. Twitter began what would become a 916,893 percent increase in SVB mentions between March 8 and March 10. Reddit thread mentions climbed by 1.1 million percent.

In the absence of any strong messaging from SVB beyond the sale, social media speculation began to take hold, and SVB lost control of the message. Social media and early financial news coverage then artificially linked Silvergate’s failure with the troubles at Silicon Valley Bank in their stories. This set up the potential for panic selling on Wall Street.

March 9, 2023

9:00 a.m EST

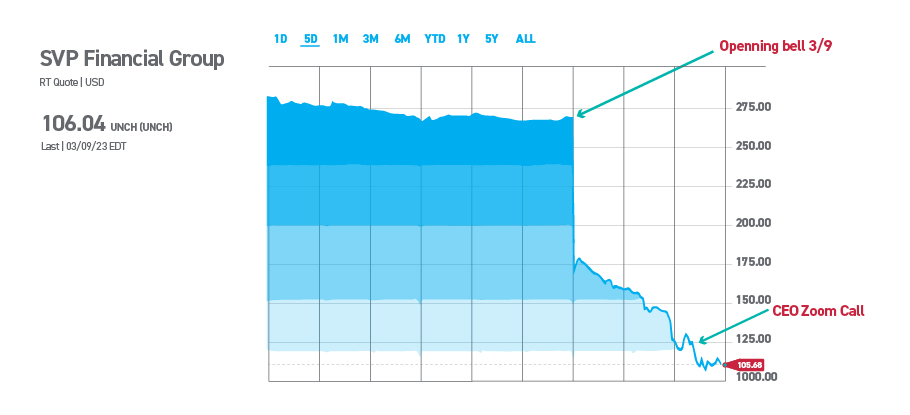

The day after the post-market announcement, Silicon Valley Bank stock, which had closed at $267.83, opened at $165.50.

2:30 p.m. EST

Nearly 24 hours after the first press release, SVB arranged a 10-minute Zoom call with “key venture capitalists and founders.” During the call, SVB CEO Greg Becker attempted to reassure attendees, many of whom were tech investors and entrepreneurs, of the bank’s improved liquidity. On the call, Becker also said, “My ask is to stay calm because that’s what is important.” He also stated, “We have been long-term supporters of you—the last thing we need you to do is panic.”

But by that moment, SVB’s stock, which had closed at nearly $268 on March 8, had dropped to a little more than $115. It would close the day for the last time at $104.51, having dropped just over 60 percent in one day.

So, the March 8 press release appears to have triggered the sell-off. That sell-off, coupled with the “don’t panic” speech, seems to have triggered a run on deposits on March 9. That amounted to more than $42 billion in withdrawals and transfers, leaving the failed bank with a negative cash balance of $958 million.

March 10, 2023

Silicon Valley Bank was seized by regulators on March 10. The California Department of Financial Protection and Innovation (DFPI) closed Silicon Valley Bank and placed it into Federal Deposit Insurance Corporation (FDIC) receivership.

The end?

Thankfully, no. While investors may be thrilled to know that the bank is getting unprecedented help and a bailout from President Biden’s federal government to prevent “contagion,” the underlying lesson in public relations for financial institutions is clear. The 16th largest bank in the U.S. did not have a PR crisis plan in place. Therefore, it was unable to deal with fairly obvious risks to its banking system and the businesses of its customers.

Fortunately, Federal Reserve Chair Jerome Powell says the collapse of Silicon Valley Bank is a financial crisis only for that bank—calling it an “outlier”—and reinforcing the sentiment that our financial system isn’t threatened. He and Treasury Secretary Janet Yellen have pledged to cover all depositors at Silicon Valley Bank and another failed institution, Signature Bank. Still, some additional regional banks came under pressure following SVB’s banking crisis, with some losing deposits to larger rivals. But while the Fed is coming to the rescue in this case, things could have turned out quite differently.

Learning From the SVB Failure: 10 Crisis PR Tips for Other Banks to Follow

Let’s first acknowledge that as human beings, we like to plan for bad news just about as much as we enjoy a good root canal. With 40 years of success, it would be understandable why an organization as influential and important as SVB might think it unnecessary to plan a press strategy in the event of a potential disaster. But even for a bank of this magnitude, it could have made a difference. Which leads to the question: what might have helped in this case?

1. Know your audience—all of them

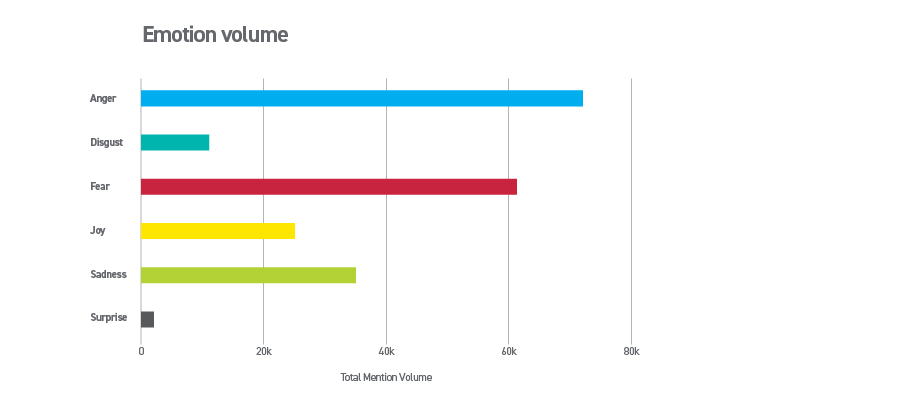

This is an area we feel confident that SVB actually had down. The fact is, even for outsiders who aren’t among the population of founders, venture capitalists, and the tech industry, it’s no secret that a culture of rumor dominates Reddit threads and private chats. Many experts are already calling this the first social media-driven bank run in U.S. history. And, honestly, they aren’t that surprised. Knowing all of your audience and how they may react in the face of adversity is critical to thinking through crisis strategy.

The lateness and selectiveness with which SVB chose to run their Zoom call showed a lack of applied strategy towards their customers who, in the absence of real and factual information, made up their own assumptions and panicked. Fully understanding your customers means you can better anticipate and manage their emotional responses in the event of a crisis.

2. Face the ugly

What are the four or five (or more?) unthinkable things that could happen to upend your institution? Do you have a few in mind? No matter how ugly those scenarios may be, that’s where you need to start planning with your crisis team. There is no guarantee that Uncle Sam will swoop in and save the day. If your institution’s survival is at stake, it’s worth “war gaming” these four of five scenarios in advance.

3. Remove the emotion

Part of a good plan is to remove ego, emotion, brand speak, groupthink, and any “drink the company Kool-Aid” mentality. Your crisis plan is not about you. It’s about managing the message that your customers take to the street. To do this, you first need research and insight into who you are speaking with. On top of that research is the realization that the inability to be objective—despite how great your ideas may seem—could kill your efforts. If your organization cannot be objective about your risks, bring in an outside consultant to guide you. Also, consider tools like anonymous online stakeholder surveys to get uncolored perspectives for your stakeholders.

4. Have a message

In examining the failure of Silicon Valley Bank, not having a clear message is one of the bank’s biggest missteps. By the estimation of many financial experts, the bank collapse could have been avoided. And, having that message could have helped tremendously. SVB made plans to improve its liquidity and solvency. The bank was acting in the interests of its customers and investors. The problem was bank officials did a terrible job of communicating those plans. In this instance, it wasn’t the plan itself. That was clearly researched tirelessly by financial experts who didn’t simply throw it together overnight. It really was a strategy to help the bank thrive. The problem came when the bank didn’t take the time to develop a digestible message that they could hammer online with social media influencers, traditional and mainstream media, and financial media outlets.

5. Control the message

If you’re not controlling the message, at the very least, you should participate in it. The lack of direct press interaction with key media outlets, the bank’s absence on social media and the slow, brief and restrictive nature of the “don’t panic” Zoom call all show that SVB did not have a strategic message plan and was not prepared to manage the message from a public relations standpoint at all. This was especially true as most national media was a little slow to run meaningfully with this story in the first 24 hours. This lack of proactive engagement with media left disproportionate power in the hands of Tweets and Reddit threads.

6. Consider the effect of bad news on customer and investor touchpoints

With SVB, several sources and social posts reported having trouble accessing the SVB website on March 9th. While it is unclear what may have caused these problems, the implication was that the site was “down” or at least bogged down by a sudden rush of traffic. That type of interruption could fan panic and increase the likelihood that depositors may want to withdraw more funds. In the event of bad or even potentially bad news, website hosting should be bolstered. Websites should have prominent home page links to FAQs. Call centers and branches should be prepared to answer questions.

7. Do not make major announcements on wire releases without a comprehensive PR plan

We could assume that SVB thought they could send out a press release and sit back and hope for the best. But in this case, the press release left more questions than answers. Even some of the more friendly financial publications showed real objectivity, if not a little hostility, at the lack of access to spokespeople to interview and question at the bank. This lonely press release ended up setting in motion a series of potentially preventable catastrophes. Press releases alone are not PR. That’s why you’ll hear it repeated that it’s essential to have a comprehensive public relations crisis plan.

8. Remember internal comms matter, too

On March 8, employees got their 2022 bonus checks. However, no information has surfaced so far that employees knew what was coming that day. Managing internal communications could have mitigated at least some of the social chatter. In the face of potentially bad news, it’s important to have all your potentially biggest fans, your employees, in lockstep on a message.

9. Mobilize social media

In the financial world, social media can be an underappreciated channel. Many business owners might be tempted to say that SVB was an anomaly. The “tech bros” are not like their customers, being that they tend to be so active on social media. But the truth is that the vast majority of 18+ adults, in general, are active on at least one or more social channels. It’s more likely that you don’t fully understand the social habits of your customers or are underestimating the value they place on getting news and information from social media. In the event of “bad” or “scary” news, social media networks are where millions of Americans seek refuge in the warm glow of advice from trusted friends, family, groups, and resources. If you have a plan that lacks a robust social media component, you don’t really have a plan.

10. Don’t say “Don’t panic”

Not to throw salt in any fresh wounds, but come on. “Don’t panic?” This is a clear sign that, beyond message planning, some media training could have really made a difference. Telling someone not to panic is like saying, “Don’t think of elephants.” Your first instinct is to do what someone tells you not to do. Media training on how to stay on message and how to avoid these types of pitfalls could have made a difference in how bank customers, media, and social media reacted.

Get Expert Help With Your PR Crisis Plan

It’s clear that SVB had challenges, and we cannot say with certainty that a great PR plan alone would have saved the institution from FDIC receivership. Still, the absence of a crisis team, lack of a comprehensive crisis management strategy, lack of a meaningful narrative for customers, and lack of an aggressive social strategy certainly seem to have sealed SVB’s fate. This led to the bank shuttering in record time.

The silver lining with frightening situations like this is that institutions all over America are now starting to think about how to mitigate their own vulnerabilities, including crisis communications management. If you need to have an honest conversation about your institution’s readiness, drop us a note or call us at 502-499-4209.

Our Articles Delivered

Signup to receive our latest articles right in your inbox.