How To Avert Bank Redlining Through Fair, Inclusive, and Innovative Marketing Practices

The term “redlining” originated during the Great Depression to describe the discriminatory practice of intentionally underserving or refusing to lend to populations thought to be less desirable. This practice was typically conducted at the neighborhood level and disproportionately affected urban areas with high concentrations of racial and ethnic minorities. Redlining was one of the mechanisms that heavily drove racial segregation in the United States. Later, legislation such as the Equal Credit Opportunity Act, Fair Housing Act, Home Mortgage Disclosure Act, Civil Rights Act, and Community Reinvestment Act (CRA) was put in place to deter lending discrimination.

Ongoing Challenges of Redlining in Modern Banking

The term still exists today, and in 2023, the Department of Justice (DOJ) reached the largest redlining settlement in U.S. history when the First National Bank of Pennsylvania settled a redlining case for $13.5 million. However, the frequency of the practice has been curbed significantly thanks to decades of regulations leading to vigilance on behalf of banks and credit unions. Yet even the most ethical financial institutions have to be mindful of continuously exercising fairness and inclusivity in their practices. Many advantages come from the modern marketing landscape due to the technologies and data that marketers possess. Unfortunately, truly fair lenders can potentially put themselves at serious risk by unintentionally excluding certain populations from their marketing offers as a result of targeting what they view as desirable audiences.

In this installment of Compound Interest, we will examine how financial institutions can steer clear of bank redlining risks from purely a marketing perspective.

- What Fair Lending Risks Do Financial Institutions Face From Redlining?

- Examples of How Financial Institutions Can Run Afoul

- Principles Are Your Foundation for Bank Redlining Avoidance

- Practices for Fairness and Inclusivity

- Get Expert Help Avoiding Bank Redlining With Fair Lending Marketing

What Fair Lending Risks Do Financial Institutions Face From Redlining?

Even if a financial institution has no intention of unfair lending practices, it can still find itself in hot water if its marketing efforts are unintentionally discriminatory. In addition to state agencies, powerful federal regulatory bodies such as the DOJ, Federal Housing Administration (FHA), and Consumer Financial Protection Bureau (CFPB) vigilantly police fair lending laws that protect against discriminatory lending and housing practices. Legal repercussions, including class-action lawsuits, can be the fate of institutions that run afoul and use unfair practices.

However, the risks to financial institutions don’t end with legal action. The disintegration of public trust is another reality that banks face if they are guilty of the practice of redlining or other discriminatory practices toward potential borrowers. The banking industry is highly competitive and is a high-trust vertical, meaning that a substantial blow to public trust can be a death sentence for a financial institution. What’s more, is that the negative effects on a financial institution’s prospects in the wake of redlining can be quite lasting. Increased regulatory surveillance after an offense can serve almost like probation for lenders, while the effects of reputational damage can last for decades in the worst of cases.

Examples of How Financial Institutions Can Run Afoul

Failing to proportionally lend to minorities

While we will mainly focus this article on marketing practices, we can’t list ways financial institutions can run awry without mentioning the most egregious practice. In the First National Bank of Pennsylvania example, the bank developed a presence in North Carolina after acquiring Yadkin Bank in 2017. Regulators found that from 2017 to 2021, other lenders originated real estate loans to minorities in Charlotte and Winston-Salem at a dramatically higher rate than FNB. This led to a significant judgment against FNB.

Failure to lend proportionately to areas within REMA

An institution’s Reasonably Expected Market Area (REMA) is determined based on several factors, including locations of branches, banking saturation in the area, market analysis, commuter trends, and more. Originating or rejecting mortgage loan applications within a specific segment of an institution’s REMA can incur serious risk.

Geotargeting in digital marketing

Excluding certain areas with higher minority concentrations from marketing efforts communicating loan products, credit offerings, rates, or special promotions can create risk. In many cases, marketers can aim to advertise in areas they see as having high conversion potential but, by doing so, exclude other areas from seeing the same messaging. This can be a less egregious or purposeful form of redlining but one that institutions still have to remain vigilant of, or else they risk facing consequences.

Misuse of first-party data

Banks should use customer data to personalize customer experience, but if the institution is nefariously profiling by demographics or geographics, it can lead to discriminatory practices.

Principles Are Your Foundation for Avoidance

In the next section, we will delve into practices and tactics to help steer clear of regulatory issues and maintain public trust. But first, we need to lay the foundation. That begins and ends with having and exercising strong guiding principles. Institutions should periodically evaluate how they exhibit the below principles as they relate to fair lending compliance and bank redlining risks:

Transparency: Providing transparency into how customer data is used is important for maintaining trust while leveraging modern marketing applications.

Accountability: It goes without saying that financial institutions must be accountable to shareholders and customers, but it’s also important for them to be accountable to the communities they serve within their REMA. That means treating communities equally and ensuring fairness in terms of financial opportunities and mortgage lending granted to different segments of the institution’s base.

Integrity: Banks and credit unions require trust in order to succeed. Acting with integrity is what maintains and grows trust in institutions. It’s a central pillar for any successful financial services provider.

Inclusivity: Not just allowing but inviting all groups of eligible people to receive the financial services of your institution is important to have a culture of fairness and diversity. It also helps grow your customer base, making it an obvious win-win to not exclude or alienate certain groups or areas.

Education: Education around financial literacy is an objective for virtually all financial institutions today. Ensuring that equal or greater outreach for financial education is conducted for underserved populations within your REMA is a great way to grow trust within your target area.

Practices for Fairness and Inclusivity

For any institution that’s aiming to avoid regulatory issues and build trust within the community, it’s important to start with principles, but in order to have a true process, you must outline at least a few practices that you will leverage to ensure compliance. Below are a few examples of tactics you should make sure you’re practicing:

Evaluate your REMA with data layers

Financial institutions should periodically reevaluate their REMA to ensure that it’s still accurate and to identify trends within it. When doing this, it’s important to look at areas of concentration for your general services as well as specific products. If an area within your REMA has strong engagement with certain products but little loan origination, you should dig into why that is. If that area also happens to be a majority-minority neighborhood, then evaluate if you’re doing everything you do in other areas to make residents aware of your loan offerings.

Continuing education for loan officers

This helps to ensure that your loan officers are up to date on the latest best practices around fair lending.

Ensure diversity representation in marketing

Whether you’re using stock images or actual customers, it’s important to make sure your marketing materials include a diverse mix of genders, races, and ethnicities regardless of whether the marketing is running in primarily minority communities or not.

Community programs

Hosting and sponsoring events and programs within your REMA can be a great way to build trust and awareness in the community, as well as educate young people about finances. Concentrating these efforts in underserved or diverse areas will help to show the public that your institution values fairness and inclusivity.

Geotarget with vigilance

Precise targeting through digital marketing channels is a great way to stretch marketing dollars and drive conversions from the most likely segments of your target audience. However, it’s important to occasionally review your targeting practices to ensure that you’re not inadvertently excluding certain areas from the opportunity to learn of your services or promotions. While traditional redlining is an act of exclusivity, the term reverse-redlining1 is a more recently termed activity, which is when institutions purposefully target certain groups with messaging about their less advantageous products or rates. Reverse redlining is a very serious matter as it displays an intent to target an audience with specific offers. It’s not very likely that a financial institution could conduct reverse redlining by mistake.

Personalize thoughtfully

As alluded to before, using customer data to personalize your customer’s outreach messaging and experience can be a highly effective tactic. Just keep in mind it’s imperative that institutions assess how they’re using personalization on a regular basis to ensure they’re not introducing any discriminatory slant to their outreach efforts.

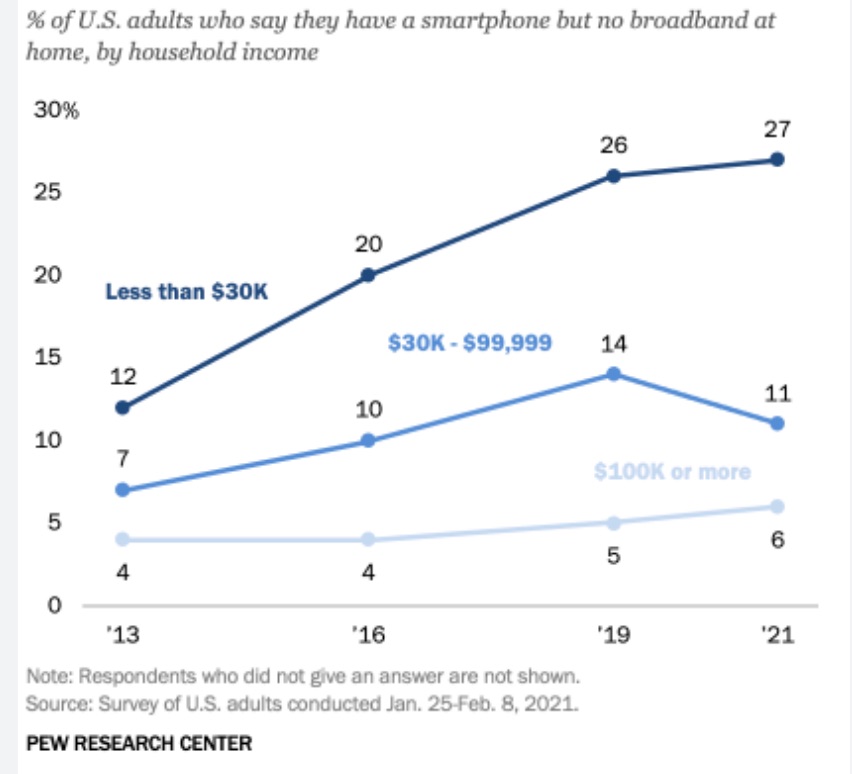

Optimize for mobile

According to a Federal Deposit Insurance Corporation (FDIC) study from 2021, mobile banking is the primary manner of accessing bank accounts in 48.8% of underbanked households. If you offer an inadequate mobile banking experience, the negative impact of this is likely to affect customers in lower-income areas more than the rest of your base.

Stay updated on the topic

The tech-based world we live in today evolves at a rate that requires businesses to pay close attention to their regulatory landscape to ensure they adhere to the latest best practices and guidance. The FDIC website is a great place to stay up to date on lending best practices in order to avoid bank redlining.

Get Expert Help Avoiding Bank Redlining With Fair Lending Marketing

It’s not enough today to not intentionally act unethically. Financial institutions must take their vigilance a step further than that by proactively assessing their practices for fairness and inclusivity. This helps guard against unintentional misdoings. In the current regulatory environment and in a society where trust is at a premium now as much as ever before, financial institutions absolutely can’t afford to not act with this level of accountability. If you’re looking for a strategic partner who can help you with an effective but fair and inclusive marketing strategy, give us a ring at 502-499-4209 or fill out the contact form on our website for a consultation.

Citations:

The Federal Financial Institutions Examination Council (FFIEC) Interagency Fair Lending Examination Procedures; page 29 https://www.ffiec.gov/pdf/fairlend.pdf.

Our Articles Delivered

Signup to receive our latest articles right in your inbox.