Endless End-To-End Digital Engagement for Financial Services?

When it comes to overused phrases, “the possibilities are endless” ranks pretty high. However, for anyone talking about digital engagement for financial services the phrase isn’t hyperbole. If you’re aiming to deliver an end-to-end digital experience for your customers, then you know that it means not only thinking of everything, but also continuously analyzing and optimizing those things as well. Which is why a great end-to-end digital engagement strategy includes basically everything except for one thing: an end.

In this edition of our Compound Interest series, we’ll dig into managing that seemingly endless cycle.

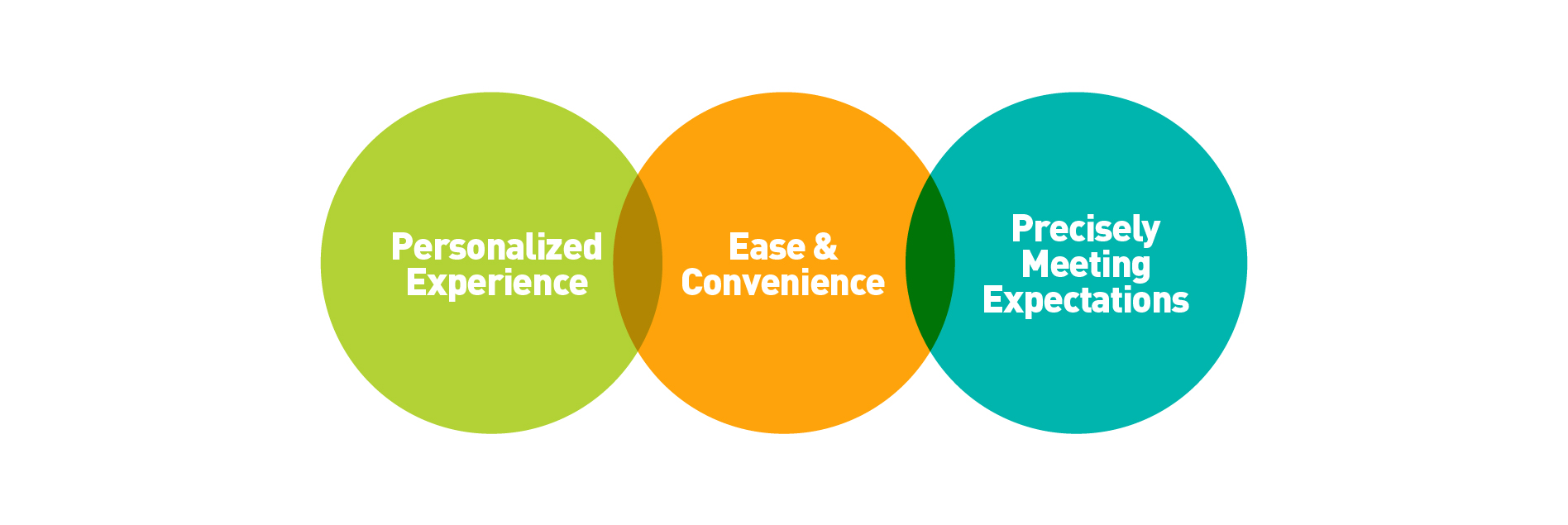

3 Pillars of Success for Digital Engagement

Before we dive into the details, let’s address the core principles that should be at the heart of every decision your institution makes regarding digital engagement.

- Personalized experience

- Ease and convenience

- Precisely meeting expectations

When companies lose sight of these pillars, that is when they lose sight of the customers’ needs.

Digital Engagement for Financial Services Customer Life Cycle

Digital Engagement for Financial Services Customer Life Cycle

The below example of a customer life cycle could represent the customer relationship for a user experiencing a traditional customer experience or a digital experience. This article will dive into each stage of the journey, what digital tactics could be leveraged at each stage and what key considerations institutions should keep in mind to ensure that their focus is still on the customer while determining the best way to implement a digital strategy for that stage.

Per the graphic, this should be thought of as a never-ending process. No matter how engrained a customer becomes in your offering, you still have to do your part to cultivate the relationship and keep their satisfaction level high.

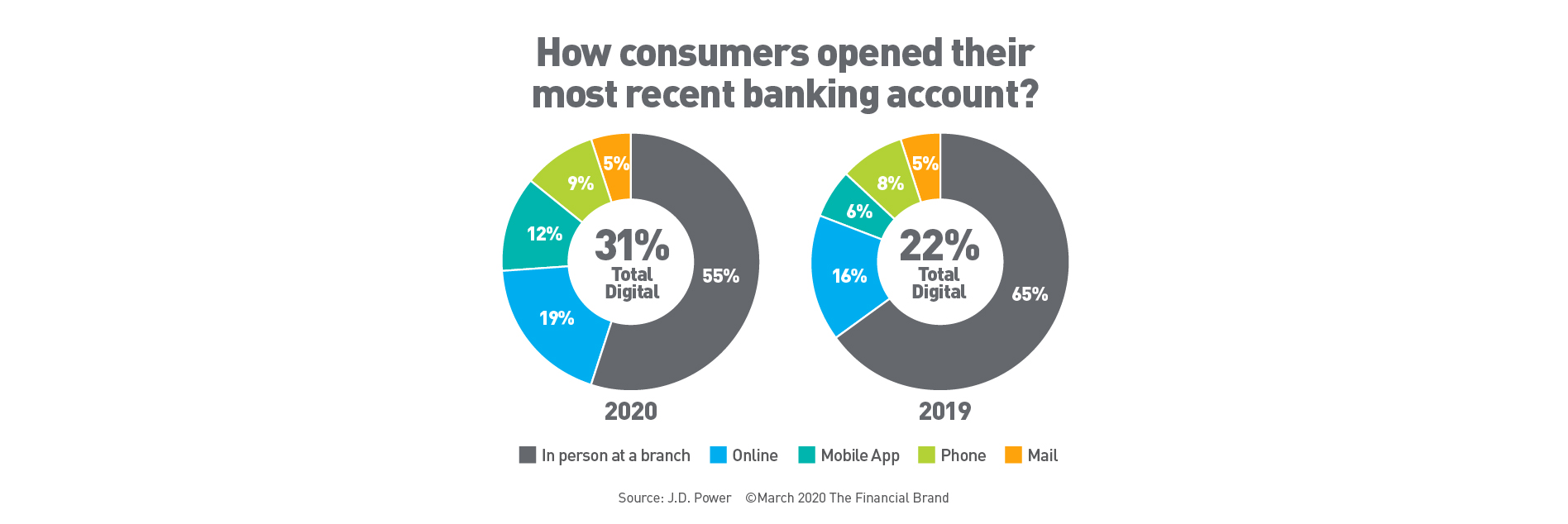

Awareness of Offering

Twenty-twenty delivered a drastic decrease in brick-and-mortar foot traffic for financial institutions. We also saw a wide array of shifts in consumer behaviors that were necessitated by the pandemic. While we don’t yet know which of those shifts will remain as the norm for different audiences, we do know that some tendencies have been forever modified. This makes it more important than ever for businesses across many industries to have a sound digital strategy. The below graphic shows a 9% year-over-year increase in bank accounts opened digitally versus in person from 2019 to 2020.

Targeting strategy

While the rise is noteworthy, it’s also important to note that if 2019 is the baseline, 22% of accounts being opened digitally is already a significant volume of bank accounts being opened online. This tells us that simply driving awareness of your offering through your digital channels isn’t going to cut it. A sound digital strategy will drive online account openings. This isn’t just about providing an option for customers to open an account online; it’s about delivering a great experience for users who are doing so and having a marketing strategy that is appropriately geared for the right mix of awareness and conversion.

Custom messaging

Once your targeting strategy is ironed out, the next thing to address is that there’s no reason that your tailoring of experience should end with targeting. Sure, it’s great to target users who are most likely to open an account due to being mid-funnel and having the right demographic or behavioral profile. However, the added benefit of hyper-targeting is that you can customize your creative and messaging by audience segment.

Using video content in your digital channels that is tailored by audience segment can make your marketing efforts feel much more humanizing and appealing to your audiences. Testimonial videos of demographically appropriate existing customers speaking to the product offerings that are the most appealing to the audience segment you are targeting will make your marketing much more humanizing and appealing for your audiences. It also gets the relationship off on the right foot by delivering a personalized experience at an early touchpoint in the relationship.

One of the most difficult dynamics about this step is the constantly evolving data regulations for advertisers using data that isn’t first-party. The fact that this dynamic is less of a light-switch effect and more of a constant evolution is the reason it pays to have a knowledgeable financial services marketing agency partner to help navigate these waters.

Initial Consideration

Once your audience is aware of your offering, they will begin the initial consideration phase. This phase won’t look exactly the same for every audience member, but if you’re leveraging a digitally driven strategy, then having an effective landing page is a must. Make sure that each of the below considerations are taken into account for the product offering page that you’re driving traffic to.

1. Relevant

The page needs to be relevant to the offering and should tie back to your outreach materials that link to it from both a visual and messaging perspective. This allows the user to immediately feel confident that they’ve landed on a page that will fulfill what they set out to do when they clicked through to begin with. This will help keep your bounce rate low.

2. Digestible

This aligns with the “precisely meeting expectation” pillar. It isn’t only important to deliver the information or resources that the audience would expect but to also reduce information that they don’t need. Leveraging video, content sliders and expandable content blocks are all ways to reduce what the audience has to read while still giving them the option to learn more when they want to.

3. Tailored

Tailoring your outreach materials by audience segment is a great start, but if you can take that further by also tailoring the landing page for various audience segments that you’re marketing to, then it completes the effect. You can use the same base content for each audience but swap out imagery based on the audience and consider prioritizing content and CTAs as well (i.e. you could give more emphasis to the mobile app for younger audiences or place the phone number in a more prominent place on the page for older audiences.) If you want to take this to the next level, consider having customer testimonials that are segmented in the same manner as your media targeting.

4. Clear CTA

Make sure that you make it clear to the audience what their next step is. Keep in mind that it isn’t going to be the same for everyone, and you can’t always control that. No matter how easy you make it for them to open an account online right then and there, some prospective new customers will want to do their own research. While it doesn’t always solve the problem, offering customer reviews or testimonials on the page may help prevent some users from moving off-site to do their own research. Whether you’re focusing on new account acquisition or customer service of existing accounts, limiting channel switching is always a positive.

Active Evaluation

As mentioned in the previous section, no matter how amazing of an on-site experience you deliver, some prospective customers are simply averse to making decisions without extensive due diligence. Many organizations struggle with this step in the prospective customer’s journey because they have the mindset that they can’t control whether an individual leaves their site, and what they find online is also out of their control.

Making sure that your business is easy to find and that your online reputation is positive can be a challenge for businesses that are operating in a crowded marketplace.

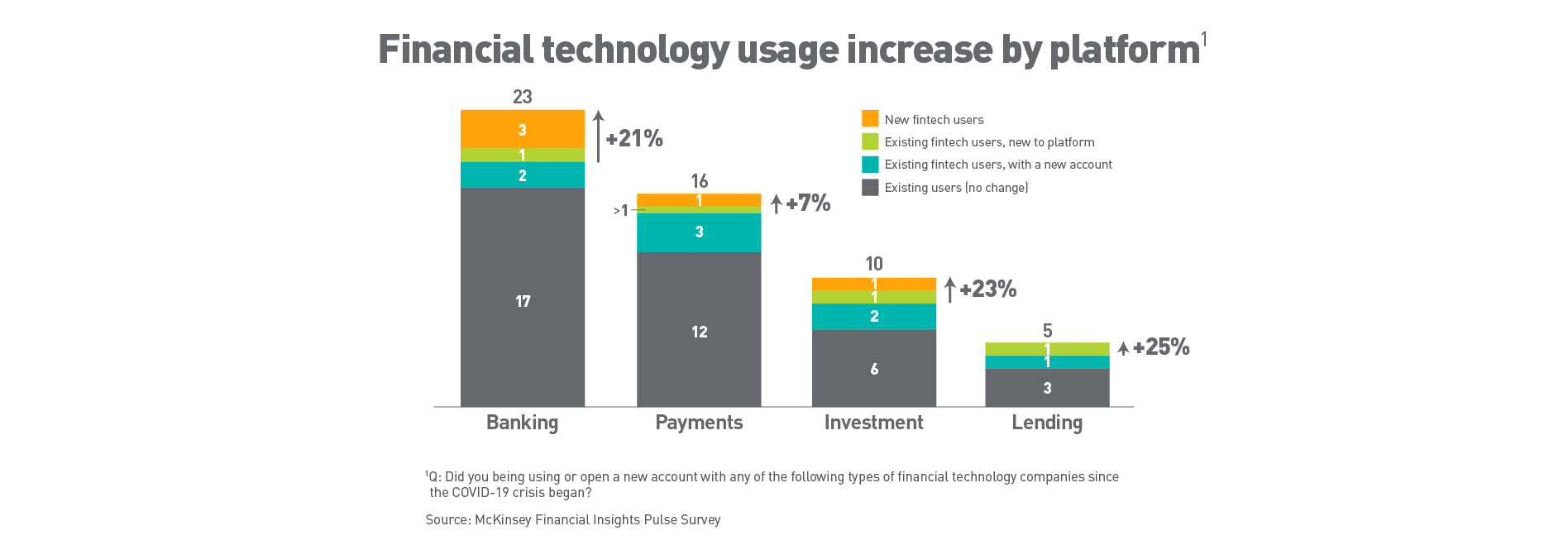

Account Opening

We already pointed out that online account openings have been on the rise. If that isn’t enough indication that online account-opening experience is important, reference the below chart from McKinsey about usage of FinTech since the pandemic. The reason this shift is important is that the more people who become users of financial technology solutions, the more users will demand digital tools and the higher their expectations will be for those digital tools. The first point of emphasis when it comes to online account opening is an obvious one, make the experience as user-friendly as possible.

Customer experience

The next tip when it comes to online account opening is to be thoughtful about exactly what happens when the user successfully completes the account-opening process. For many organizations, they’re using a third-party provider for their account-opening functionality. This may limit control over every aspect of the process, but it’s no excuse to not worry about where the user is taken once they complete the form.

If a customer walked into your lobby and opened an account, you wouldn’t end the conversation as soon as they finished and wait for them to receive an email with new customer orientation information. You would tell them in person about the benefits of their account and how they can get the most use from your product.

This should be done online as well without forcing the user to check their email for instruction. Consider having a video with a member of your leadership team who thanks them for opening their account and then walks them through how they can use their account or earn rewards from it. By doing this rather than counting on them to open a follow-up email or seek out information themselves on your website, you’ve reduced the chance that the customer won’t become dissatisfied due to not knowing how to take full advantage of your product offering.

New Customer Orientation

New customer orientation is a critical component of the relationship, as it can have a dramatic impact on both customer satisfaction and the value that the institution derives from the relationship. There’s a wide array of ways to do this in digital form that are both effective and convenient for the customer. However, there are a few key rules of thumb to keep in mind.

1. Materials should be tailored

If a customer begins reviewing orientation materials and realizes that they’re full of general boiler-plate guidance rather than specifics about the type of account they opened, they’re less likely to stay engaged with the content. Furthermore, even if they are engaged, the material itself is likely less effective due to not being specific. As with the example in the previous section of a video that thanks the customer for opening their account and then walks them through how to use it, this experience is not only beneficial to both parties, it also delivers a wow factor by being in video form, yet still tailored to the situation.

This delivers a great experience for the customer while also showing appreciation for them and providing them with the information needed to best use your offerings. As the financial institution, you will be rewarded by having a customer that’s not only more loyal than they would have been otherwise, but also one that’s likely more valuable to you because they know how to use your offerings in the manner that you intended.

2. Easy to use

New customer orientation shouldn’t feel like a burden. If it does feel overly cumbersome, then customers won’t complete it. This gets the relationship off on a bad foot right out of the gate and is also likely to cause future frustrations due to the customer not being educated on the specifics of their account.

3. Precisely meeting expectation

This is an easy objective for companies to overlook while trying to think of every possible thing a customer might want to know (or every product you offer that you would like them to use). Focus on giving them exactly what they need in a concise manner that isn’t overwhelming and support that with links and user-friendly navigation to related topics that they might want to learn more about.

Ongoing Support

It’s no secret that customer satisfaction is a key ingredient for financial institutions. What’s important to keep in mind, though, is that many customers don’t really think about your customer service until they suddenly have a problem, and then how that problem is handled in that very instance immediately shapes their entire perception of how your organization supports its customers.

Strive for consistency

Why is that important? For starters, it stresses the need for consistency. Many institutions love to champion that one unbelievable customer experience story that gets posted on the bulletin board and the CEO shares during a board meeting, but the reality is that customer satisfaction is really driven by consistent repeatable experiences.

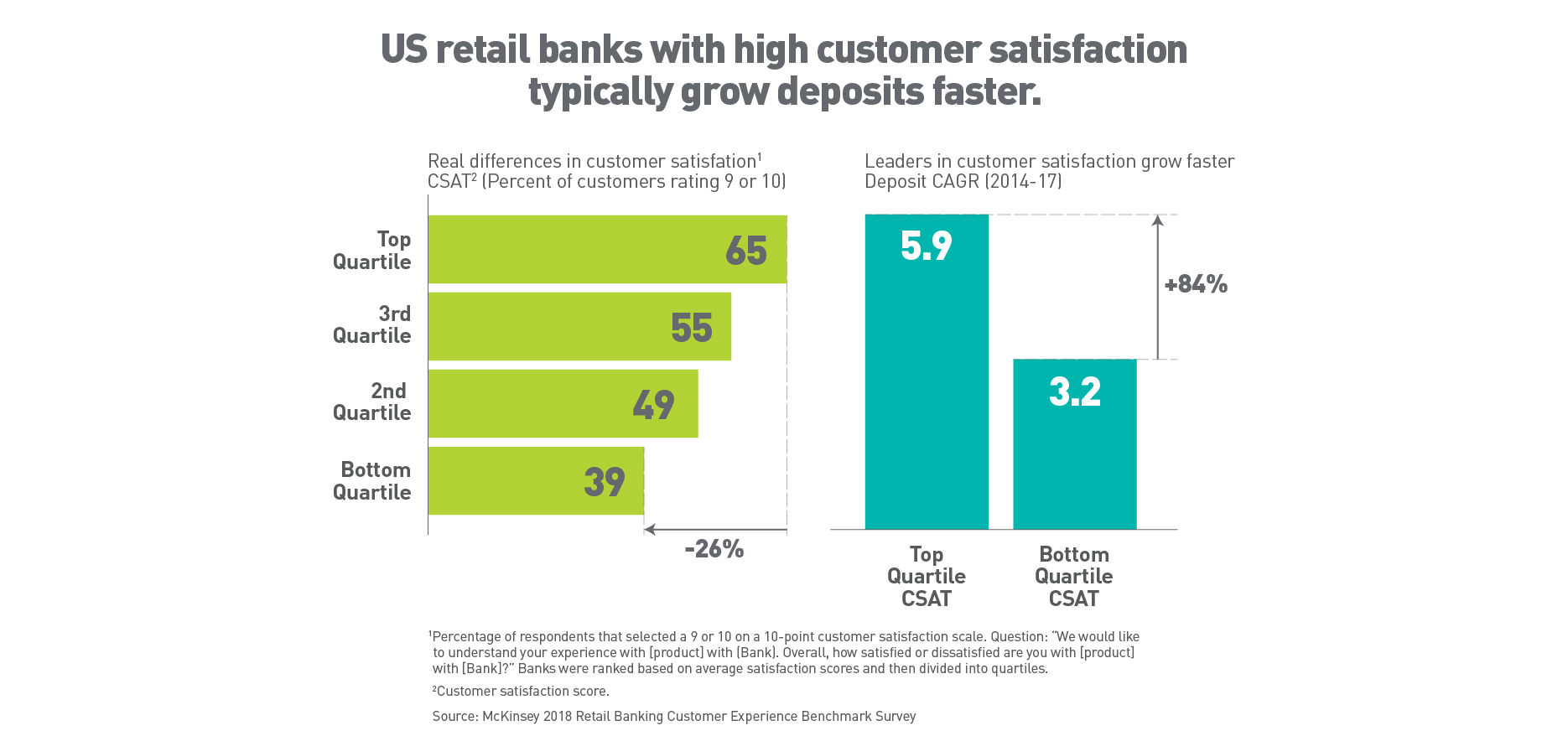

Most customers don’t really expect you to blow them away with a single, over-the-top experience, but rather, they don’t want a problem to arise and spiral into a situation that takes up their time. It only takes one bad experience for a customer to take their business elsewhere. Furthermore, companies that deliver great customer experience on a regular basis aren’t just rewarded with high retention rates; the below chart from McKinsey shows a strong correlation between customer satisfaction and deposit growth.

Analysis and Optimization

Maintaining a disciplined feedback loop is essential for having transparency into how you’re performing when it comes to digital customer engagement. Since we are talking about digital engagement, it’s easy to jump to analytics, but regardless of whether you’re monitoring customer engagement in or on the web, a healthy mix of data analytics with qualitative customer inputs is necessary to have a clear view of the big picture.

Audience subsets

Speaking of the big picture, don’t forget to also drill down to specific subsets of your audience to see how you’re performing with various groups. Your overall satisfaction could be high across every measure when looking at your full audience, but you could be falling perilously short in a measure that’s critical to a specific subset of your customer base.

Data prioritization

Lastly, be sure to prioritize the data that you compile. Any measures that relate to how easy (or difficult) you make things on your customers should be top of mind when it comes to analysis. Taking this a step further, always be on the lookout for any small ways you can save your customers’ time when you’re analyzing operations and looking for areas to improve.

Of course, deriving value for you and your customers is important, but saving customers a little bit of time here and there is often lower-hanging fruit that can have significant benefits. The one experience that causes a customer to leave their financial institution is frequently caused by or worsened by an action that absorbs a disproportionate amount of the customer’s time.

Cross-Selling

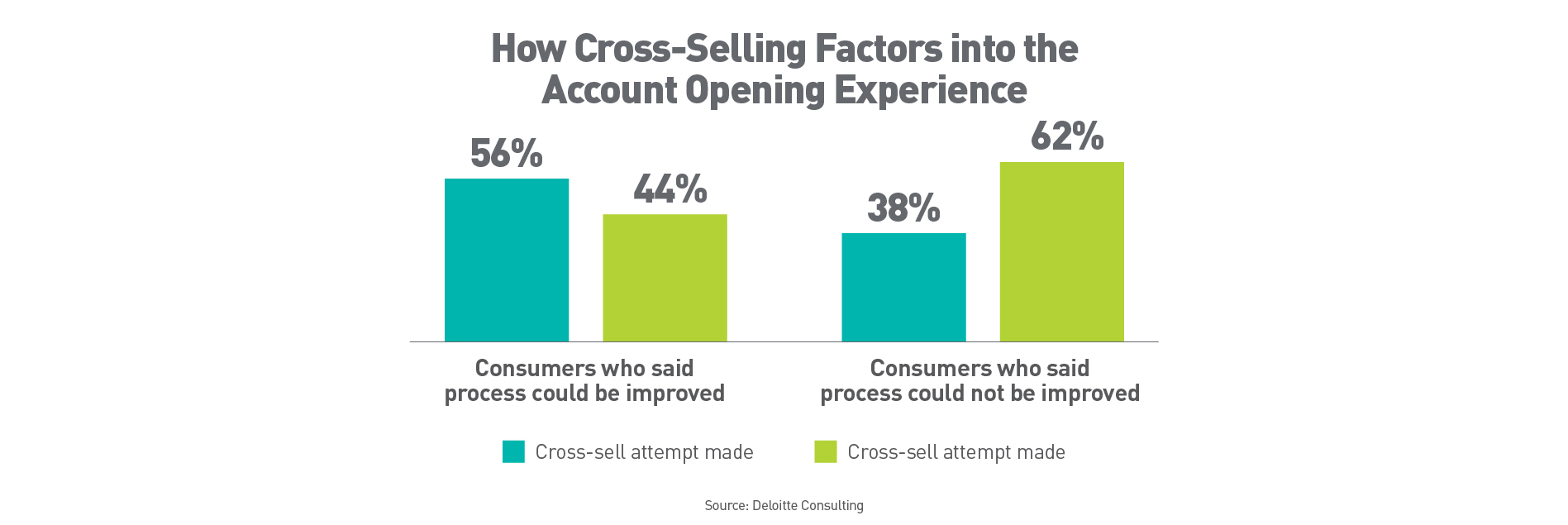

While the upside of effective cross-selling is quite obvious, it’s also important to be mindful that when done poorly, cross-selling can lead to a negative customer experience. The chart below from Deloitte shows that customers who are exposed to cross-selling are more critical of the account-opening experience than customers who aren’t exposed to cross-selling.

The other factor to keep in mind is that the general public is more aware than ever before of what data they should have access to. If your cross-selling attempts aren’t relevant to the customer because you are not leveraging the first-party data that’s at your disposal, then this can prove to be an agitating realization for the customer.

Many organizations are guilty of having more refined targeting using third-party data when marketing to prospective customers than when they’re cross-selling to existing customers due to inadequate use of first-party data. Put yourself in the shoes of a customer experiencing that dynamic and imagine how it would make you feel. You would feel like the organization was willing to put much more effort into acquiring you as a customer than they were willing to spend in making sure that they save you time after you’re already a customer. Needless to say, this isn’t how any organization would want their customers to feel.

Using first-party data to both tailor the products you pitch in cross-selling efforts and to personalize your messaging will make your cross-selling efforts more fruitful for you and more beneficial to your audience while also humanizing the experience.

Avoiding Pitfalls

Digital engagement for financial services really is a never-ending quest for excellence. Every step of the journey should deliver a personalized experience that demonstrates a genuine effort to save your customers time. Of course, this is much easier said than done. All organizations are going to experience growing pains during their shift toward putting more emphasis on digital customer experience.

The key is to be alert to those stumbles as they happen and have a process in place to analyze and optimize the experience you’re delivering. Many organizations go into this process with the leadership, knowledge and great intentions needed to make it a success, but they still struggle with the challenges of digital engagement due to being too deep in the weeds. This is where it can help to have strong outside council in the form of a knowledgeable Board of Directors and vendor partners with expertise.

Get Expert Help With Digital Engagement for Financial Services

If you would like to learn more or discuss ways that your organization can prioritize end-to-end digital engagement for financial services, please give us a call at 502-499-4209. You can also drop us a note here to have one of our experts reach out to you.

Our Articles Delivered

Signup to receive our latest articles right in your inbox.