Financial Services Branding for Traditional Institutions: Can You Bank On Your Brand?

For traditional banks and credit unions that enjoy strong name recognition, the value of their name carries equity. For many years, this has been a fixed dynamic that isn’t lost upon anyone in the industry. Over the last few years, traditional institutions have had to compete more and more for customers with non-traditional entrants to the industry. Conventional wisdom has been that this disruption means that traditional institutions should begin investing more in technology. But what should it mean for their marketing investment?

In today’s edition of our Compound Interest newsletter, we’ll look at the value of financial services branding for traditional banks and credit unions. We’ll explore why your focus on innovation can’t come at the expense of your brand.

- Balancing Innovation and Branding for Long-Term Growth

- Factors Challenging the Status Quo

- Factors Impacting Customer Behaviors and Needs of Financial Institutions

- How Can Traditional Banks and Credit Unions Combat This With Smart Financial Services Branding?

- Get Expert Help With Financial Services Branding

Balancing Innovation and Branding for Long-Term Growth

It’s important to mention that many of the new technology-driven entrants to the financial services industry are both providers and competitors to traditional financial institutions. However, for this article, we’re focusing on the potential threat of traditional institutions losing customers to non-traditional companies. According to a global financial services leaders see new technology as a threat to their business model.

Traditional banks and credit unions have felt the need to compensate for technology by placing more emphasis on innovation. However, their non-traditional competitors have felt they need to compensate for their lack of brand recognition by spending more on marketing in relation to total assets than traditional banks.

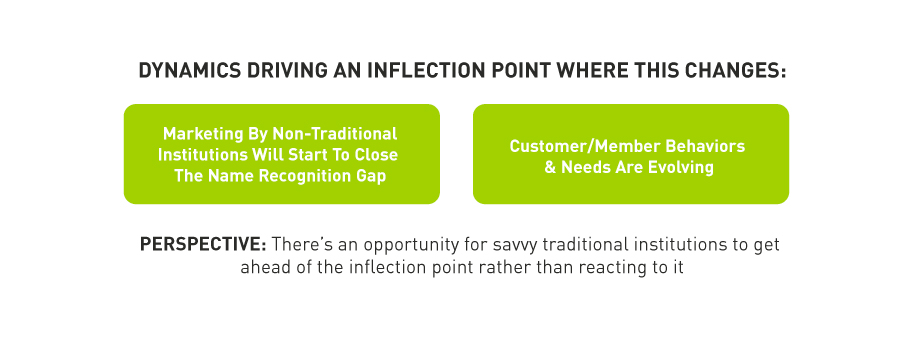

An opportunity and a risk

While this current thinking is completely logical and is most likely correct for right now, it also represents both an opportunity and a risk for traditional financial institutions around realizing the inflection point where their dollars need to begin to shift. After all, name recognition isn’t purely a matter of how long a company has been around. Plenty of modern, tech-based startups in other industries have proven that theory to be wrong over the past few years. In the financial services space, there are two dynamics affecting just how quickly this inflection point will be reached. One is the level of marketing being done by non-traditional institutions in order to overcome their lack of name recognition. The other is that customers themselves are changing. We will get to this in more detail later, but the latter of those two dynamics was accelerated by the global pandemic.

Factors Challenging the Status Quo

- Marketing spending by non-traditional entrants to the industry is growing. One prime example is Varo Bank, a neobank founded in 2015, that launched a massive marketing campaign this year that even included a TV spot during the Super Bowl.

- Growing investments are being made in the fintech space. A record of $55.3 billion of investment deals were made in 2019 related to fintech investment. This decreased in 2020 during the pandemic but is set to rebound in 2021. Per-share price of Global X FinTech ETF (FINX) more than tripled from $15 in 2016 to $47 in 2021.

- In many cases, fintech firms are well positioned to leverage first-party data to stretch their marketing dollars further.

- The pandemic caused brand affinity for companies that fulfilled needs during that time. A 2020 study from an intelligence company found that the brands that increased their brand affinity between March and July of 2020 were Zoom, TikTok, Instacart, and Headspace. Each of these brands used digital solutions to meet consumer needs during the crisis. When it comes to consumer needs, financial needs rank very highly. Therefore, it stands to reason that innovators who made the financial needs of users more accessible during the pandemic through digital solutions gained brand affinity as a result of this.

Factors Impacting Customer Behaviors and Needs of Financial Institutions

1. Customers are becoming more accepting of digital-only relationships with financial institutions.

A reported 30% of respondents had a digital-only experience with their institution, and these users reported the lowest satisfaction scores of all respondent segments in the study. However, a repeat of the study was conducted in April of 2021, and this time, around 41% reported a digital-only relationship with the segment showing much-improved satisfaction scores over the 2020 results.

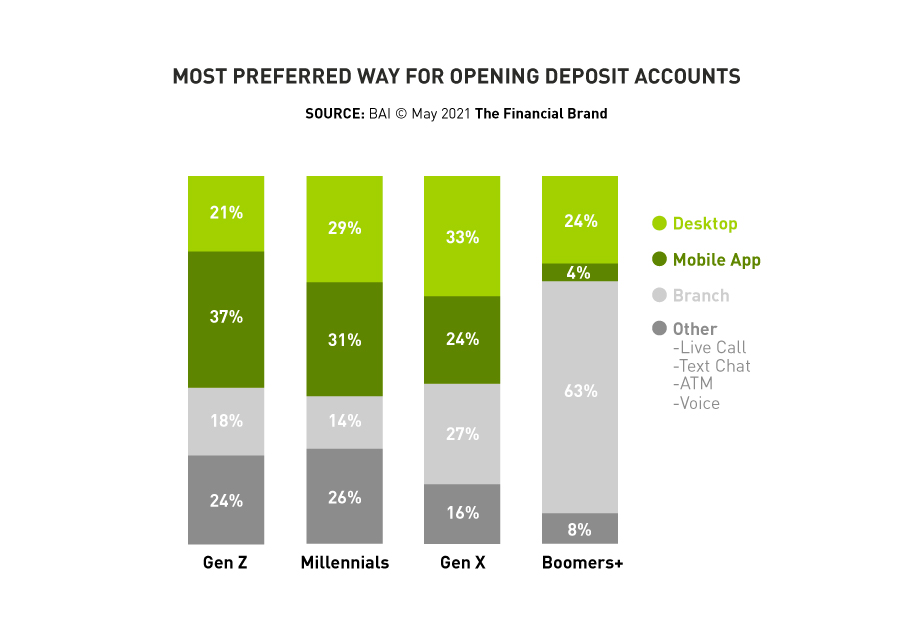

2. There’s a generational divide when it comes to willingness to open a deposit account online.

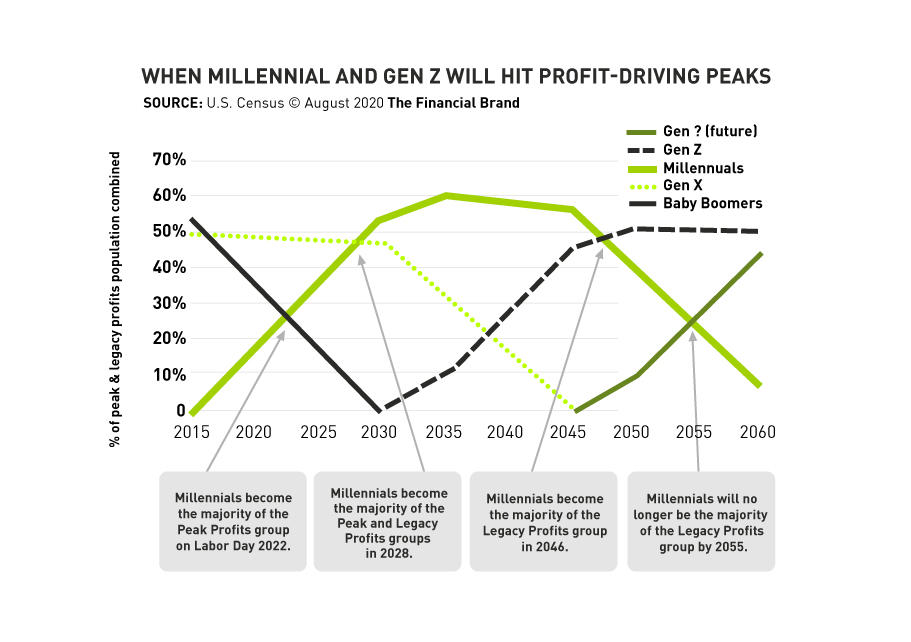

Sixty-three percent of Baby Boomers prefer to open an account in person at a branch. That number drops sharply with Gen X. Millennials responded that 79% have opened a deposit account online and that 85% would be willing to move to a non-traditional bank. This divide is going to become more important as millennials reach their profit-driving peak, which is right around the corner.

3. Two large generation populations.

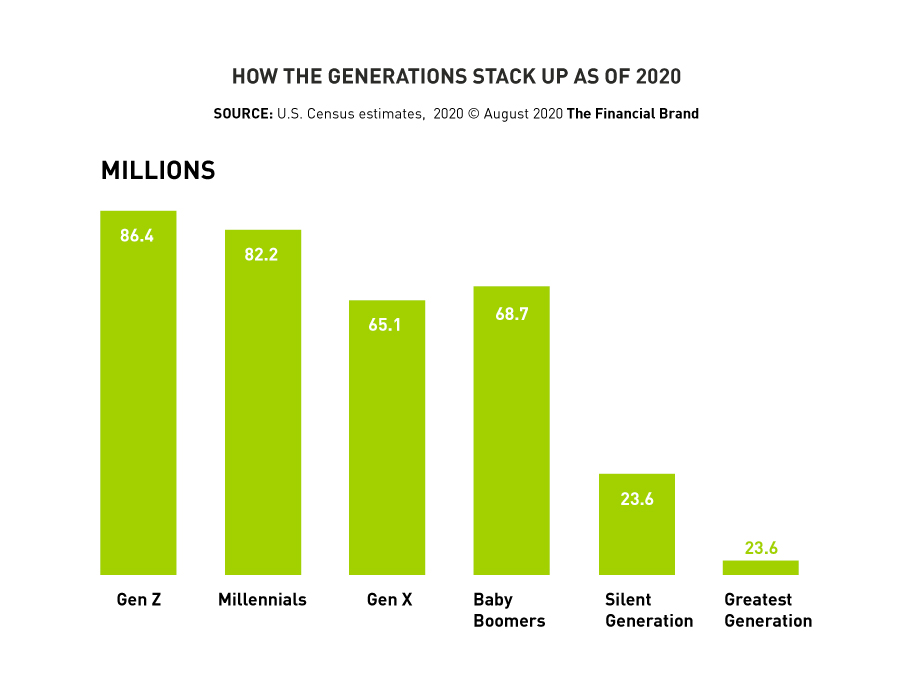

Building further upon these generational trends is the fact that Gen Z and millennials are now the two largest generations from a population perspective.

4. As Gen Z becomes more financially independent, they could signal a greater shift toward non-traditional banks.

The good news up to this point for traditional financial institutions has been that 61% use the same primary financial institution as their parents. However, the same study concluded that 59% of Gen Z respondents were financially independent. The similarity of these figures doesn’t seem ironic. It stands to reason that as members of the Gen Z audience grow in their financial independence, they will also become less attached to the financial institution that their parents are with. This is why the urgency to build affinity now with the Gen Z audience outpaces the inflection point at which they will come anywhere close to their peak in terms of driving profits for financial institutions. It’s more cost-efficient to keep them now than it will be to win them back later.

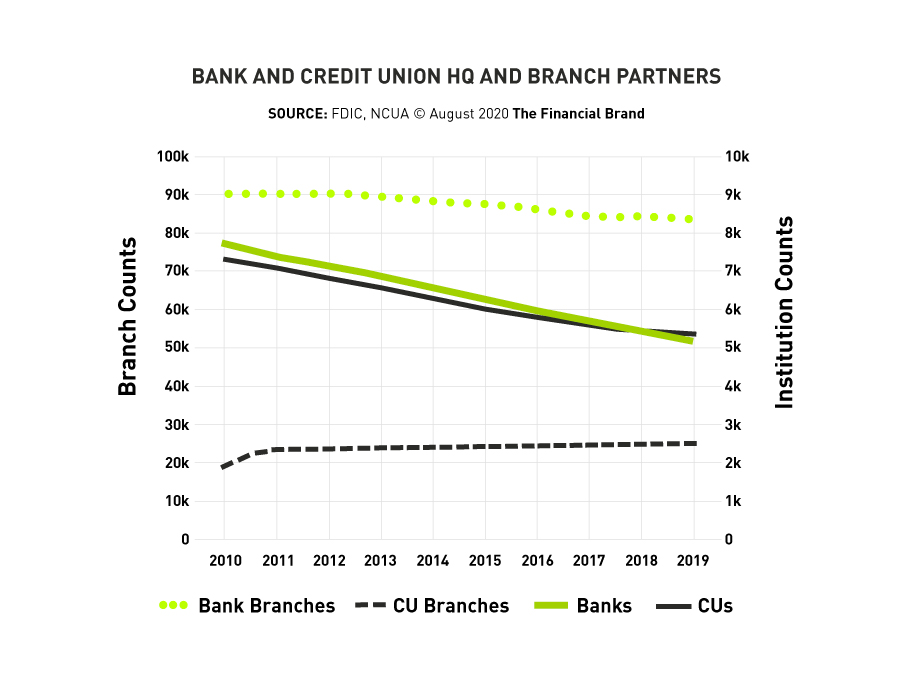

5. Physical branches are on the decline.

Locations have been declining by 2% annually for a decade now. Physical locations are part of traditional institutions’ foundational staying power. As the number declines and users make more and more transactions online, the branches and signage will represent less and less of an avenue for brand awareness of traditional banks.

How Can Traditional Banks and Credit Unions Combat This With Smart Financial Services Branding?

While the obvious answer is to spend more on marketing, we understand that nobody has an unlimited budget for these things. Below are a few ways traditional institutions can get the most bang for their buck when it comes to financial services branding.

Use first-party data to make communications to existing customers/members as effective as possible.

Utilizing data collected directly from customer interactions means traditional banks can gain important insights into preferences, behaviors, and needs, enabling personalized and timely messaging. This approach works by fostering stronger customer relationships and enhancing brand loyalty and trust. If you integrate these insights into your marketing and branding efforts, your bank or credit union can deliver more relevant and impactful communications. This can lead to better customer retention and the ability to compete more effectively against fintech disruptors.

Continue to diversify where your marketing dollars are being spent.

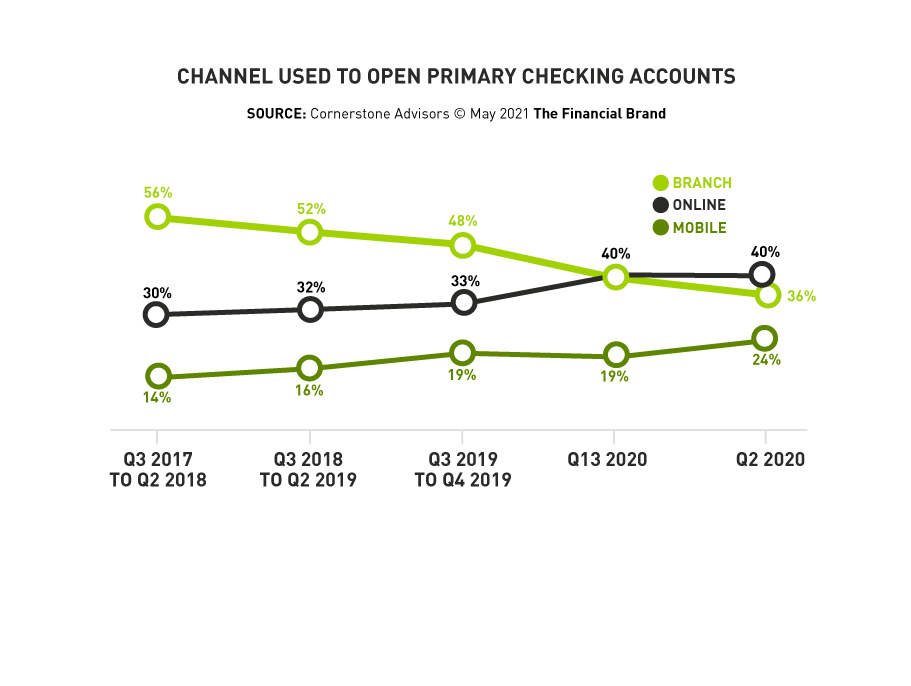

We already hit on the trend of physical branches declining, and more users are opening accounts online. It’s important that traditional banks don’t exacerbate this by placing too much of their marketing budget in channels that don’t allow for an online account opening. Not only are online account openings on the rise but so are mobile. Having this functionality, ensuring that it’s a good experience and making sure that your marketing is driving these activities is a great way for traditional banks to not lose ground due to changes in consumer behavior.

Think socially and bring your message to life.

Advertising spend on social media is growing across all industries and financial services is no exception. One complexity in this is that social platform preferences vary by generation. However, engaging video content plays well with all audiences and all platforms. Financial brands should develop a plan for building their video content library that aligns with their strategic goals. This will help to ensure that banks and credit unions will have impactful content to leverage, regardless of whether their marketing dollars shift from one platform to another.

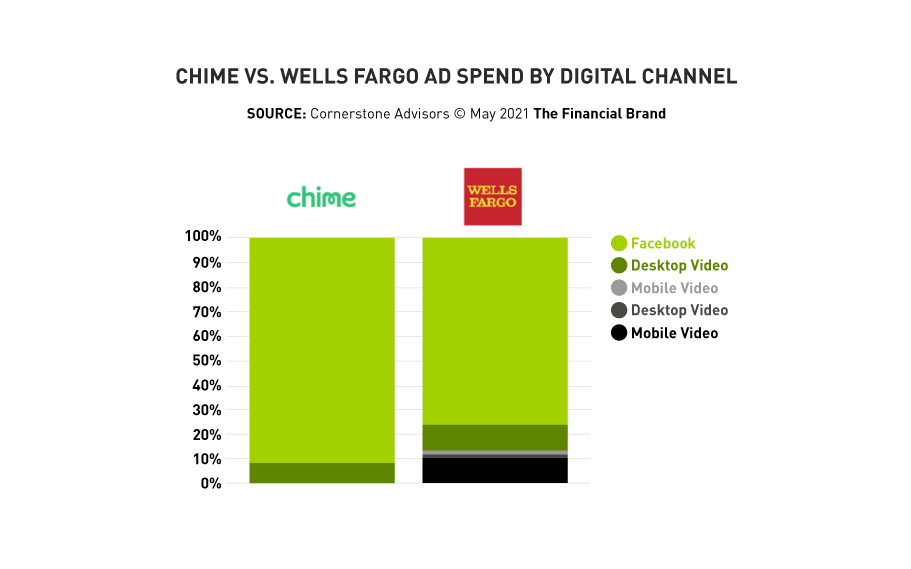

The graphic above shows how an overwhelming percentage of Chime’s marketing spend is going to Facebook. The remainder is on desktop video. Wells Fargo’s ad spend actually doesn’t look as different from Chime’s as you might think. The point is that both of these brands benefit from strong video assets with what they’re currently running, but those assets also give them the flexibility to switch platforms if their strategic priorities shift.

Get Expert Help With Financial Services Branding

If you would like to learn more or discuss ways that your organization can be more strategic with its marketing efforts, please give us a call at 502-499-4209 or drop us a note here to have one of our experts reach out to you.

Our Articles Delivered

Signup to receive our latest articles right in your inbox.