Gen Z Bank Marketing: 4 Insights for Financial Services

Effectively targeting and attracting Generation Z depositors must be a key component of bank marketing plans in the mid- and long-term. This is to replace the current boomer customer base as these consumers transition to drawing down assets in retirement.

In this edition of our Compound Interest series, we’ll look at Gen Z bank marketing. We’ll help break down critical experiences, characteristics, and drivers for Generation Z that impact their decisions about financial services.

- Who Is Gen Z?

- 1. Financial Prudence is the New Normal for Gen Z

- 2. Seamless Mobile Experience Is Key

- 3. The Great Recession and Residual Impact Damaged Trust

- 4. Key Role of Social Media and Influencers

- Get Expert Help With Gen Z Bank Marketing Strategies

Who Is Gen Z?

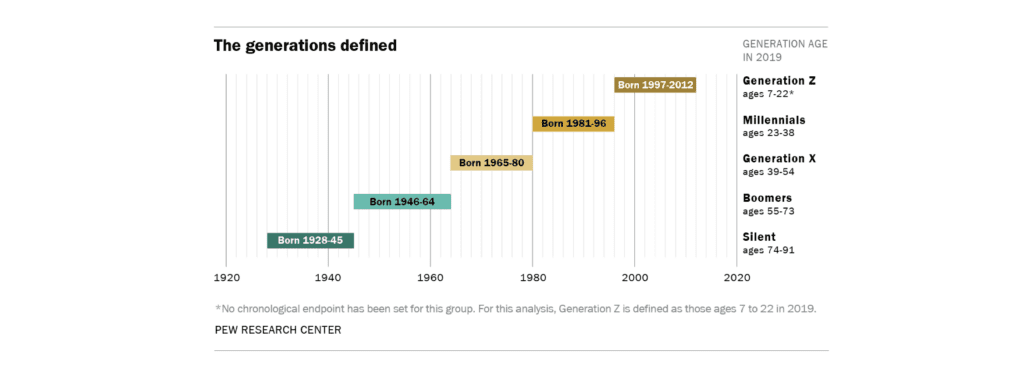

Generally speaking, Gen Z includes individuals ranging from third graders to recent college graduates. Their early lives were defined by the Great Recession. However, they were too young to recall the events of September 11, 2001.

Education

Gen Z is less likely to drop out of high school and more likely to be enrolled in college. This trend is driven in part by second-generation members of the Hispanic community, whose parents have emphasized the importance of a college education for future economic prospects. Additionally, Gen Z generally grew up in slightly more affluent circumstances than previous generations.

Economic situation

Unlike the millennial cohort who came of age during the Great Recession, Gen Z was expected to inherit a strong economy with record-low unemployment. The sudden arrival of COVID-19 has disproportionately impacted Gen Z families and dashed some of these optimistic economic prospects. Nearly 50% of older Gen Zers reported that they or someone in their household had lost a job or taken a pay cut as a result of the coronavirus pandemic. Additionally, younger workers are overrepresented in high-risk service-sector industries. As a result of in-progress educational attainment, Gen Z is less likely to be working in their teen and young adult years than previous generations.

Politics

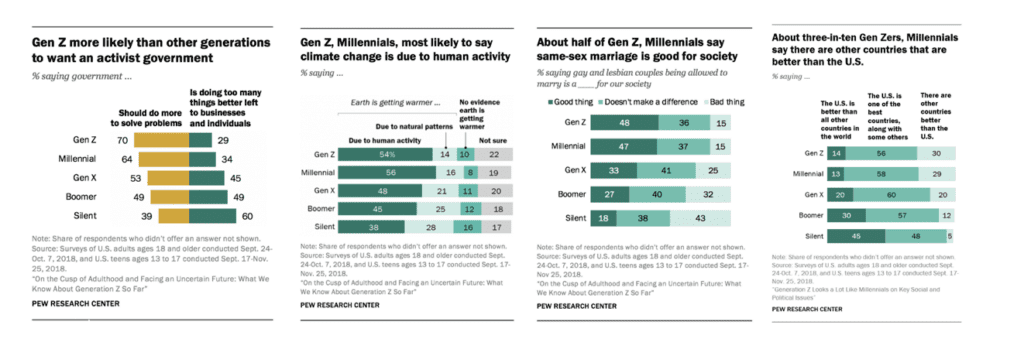

From a political standpoint, Gen Z is more likely than older generations to look to the government to solve problems rather than businesses or individuals. Seven in 10 Gen Z members say that the government should do more to solve problems like climate change, systemic racism, same-sex marriage, and other issues. Members of Gen Z are also more likely than their generational counterparts to disagree with the statement, “The United States is the best country in the world.”

Demographics

Demographically, Gen Z represents the leading edge of the country’s changing racial and ethnic makeup (52% of Generation Z is non-Hispanic white, and one in four Gen Zers are Hispanic.) Members of this generation are less likely to be immigrants to the United States but more likely to be children of immigrants than the millennial cohort (22% have at least one immigrant parent.) As is already the case on the West Coast and in metro areas, Gen Z is projected to become the majority non-white in 2026 due to continued immigration.

Technology use

Finally, members of Generation Z are tied to their phones to a degree not previously seen.The iPhone launched when the oldest member of Gen Z was 10 years old. As a result, Gen Z has surpassed the millennial “digital natives” to become the first “mobile natives.” Staggering adoption rates like 95% access to a smartphone and 97% usage of one of seven major online platforms are evident in the generation that reports being online “almost constantly.” Gen Z assumes constant connectivity and on-demand entertainment (some 90% of Gen Z report playing video games.) Some recent research has suggested that this significant “screen time” is contributing to rates of anxiety and depression.

These demographic and online usage trends point to four key focus areas for financial services marketers.

1. Financial Prudence is the New Normal for Gen Z

Having seen their parents or slightly older millennial cohorts face financial challenges, Gen Z has responded by saving more, thinking through purchase decisions, and avoiding credit mistakes millennials made (particularly with student loan balances). Some 70% of Gen Zers monitor finances on a daily basis.

Implication:

Financial services brands have a clear opportunity to help Gen Z “get to where they want to go.” They can do this by providing educational resources to help younger consumers learn and perfect budgeting and expense management. Simple and direct messaging, along with video content, can be particularly effective in this endeavor.

2. Seamless Mobile Experience Is Key

Members of Gen Z are comparing financial services mobile apps to every other app across all categories on their phones, including mobile-first fintech firms. Frictionless connectivity is the basic expectation among Gen Z, necessitating navigable content served appropriately across multiple touchpoints with an emphasis on video and micro content. Established firms, community banks, and credit unions alike must be able to compete on home screens and in these contexts.

Implication:

Financial services firms must effortlessly fit into Gen Z’s lives. Legacy technology systems are no longer an excuse. Take action to modernize IT systems and enable the delivery of perfect digital touchpoints and on-demand customer utilities.

3. The Great Recession and Residual Impact Damaged Trust

Only 34% of Gen Z and millennials trust banks. Generation Z is more vigilant and suspicious of the financial services sector due to the fallout from the Great Recession. This skepticism leads them to consider new entrants and category disruptors, which they perceive as more authentic and trustworthy.

Implication:

Financial services brands must clarify their purpose and pursue that purpose from within their organizations, beginning with their employees. From a positioning and messaging standpoint, legacy firms must emphasize these actions and work to emulate startups and category disruptors.

4. Key Role of Social Media and Influencers

Unlike millennials and previous generations, mobile phones are the windows through which members of Gen Z see the world. Social media specifically exposes this generation to new products and services and also where it gets its news.

Implication:

Financial services brands should engage influencers and prioritize social-based advertising channels to tell their brand story and walk through convenience products. Further, an opportunity exists to utilize existing CRM programs to encourage parents in their 40s to open accounts for their children. This parent audience is far more likely to recognize the value of financial responsibility early in life.

Get Expert Help With Gen Z Bank Marketing Strategies

By starting out with a clear understanding of the factors driving Generation Z decisions, savvy banks and credit unions will get a head start on the competition and cultivate trusting, long-term relationships with them. We believe this is a smart long-game strategy that will deliver ROI for decades to come.

To learn more about Gen Z and banking, or if you have any questions about this or other articles we’ve produced, please call us at 502-499-4209 or contact us here to schedule an appointment.

Our Articles Delivered

Signup to receive our latest articles right in your inbox.