Centra Credit Union: Integrated Media Strategy

A data-led marketing approach that combined digital and traditional media to strengthen brand awareness and support local branch goals across 60 counties.

Challenge

Centra Credit Union operates in Indiana between the Indianapolis and Louisville DMAs. It has 24 locations across a 60-county service area, with the bulk of its membership in rural counties throughout central and southern Indiana. With dual goals, PriceWeber was tasked with overall branding and general awareness across its total footprint and increasing membership through a series of products (checking, savings, mortgage, deposit, etc.). Additionally, individual branch managers had location-specific goals, combined with varying audience demographics and media consumption habits.

Before working with PriceWeber, the brand primarily relied on traditional cable, radio, print, and outdoor advertising, and did not incorporate any digital elements. While this was fine for their older, established audience, they were not successfully reaching the younger Millennial and Gen Z segments, who are key to future sustainability.

Solution

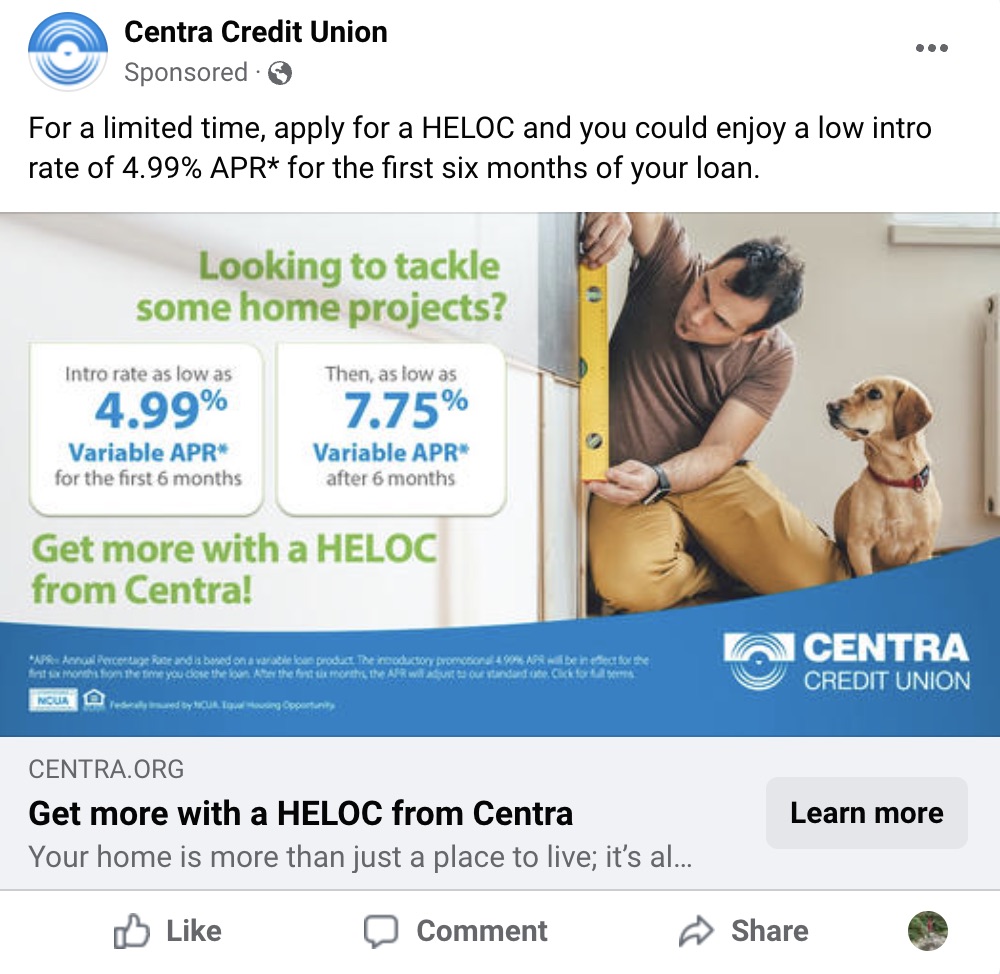

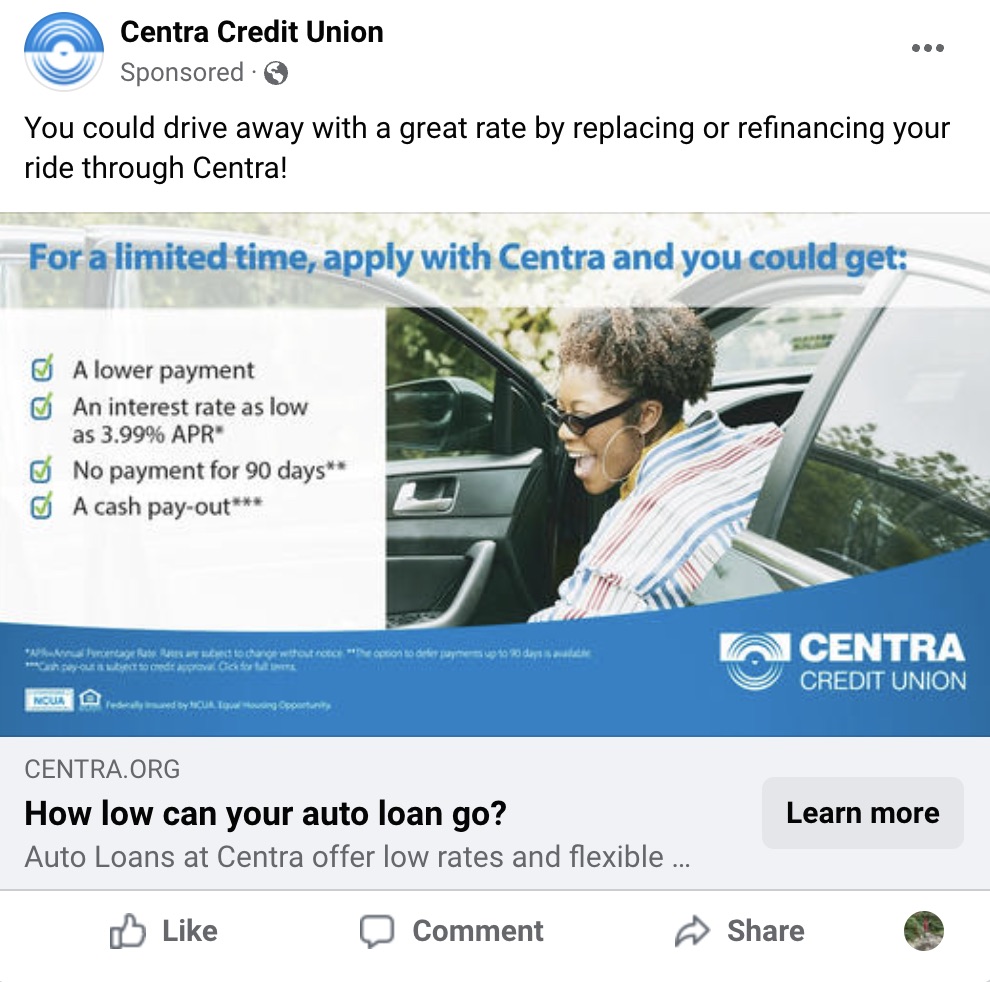

PriceWeber developed an audience segmentation strategy that allowed Centra to customize messaging based on key generational insights and leverage advanced digital targeting to deliver the most relevant message to each audience. The brand was front and center in each message, but each product was also taken into consideration, along with consumer life stage and need. For example, mortgage campaigns featured a “dream home” message that was delivered to older potential consumers or those looking for second or third homes, while a specific first-time homebuyer message was served to younger consumers and first-time homebuyers based on available data.

In addition to audience segmentation, geographical priorities played a major role in optimizing the available budget. For example, when promoting business banking, the locations in rural counties focused on small-business banking opportunities, while locations within the Louisville and Indianapolis DMAs focused on commercial business banking. The geographical data was paired with offline business data to segment businesses within each area by industry using NAICS codes, company size (based on number of employees), and total revenue, and to segment messaging that would resonate with both.

Contingency funds were set aside for each branch location. In addition to the overall branding campaign that covered all locations, we also leveraged other media vehicles to achieve branch goals. In rural counties, we found that the local paper and radio stations were still heavily utilized, compared with more populated service areas where we primarily used digital tactics. We identified individual outdoor boards, newspapers, and local radio stations to address specific needs within individual markets and provide tailored coverage for each geography.

The brand plan included video (cable and OTT), audio (traditional radio and streaming), social media, search, native, and display. Additional targeting was layered by the product promoted (e.g., mortgage vs. business banking). Branch-specific plans layered in additional dedicated digital, along with outdoor, print, and local radio.

Results

PriceWeber was able to attribute a 28% increase in year over year online account opens and 20% total increase in website traffic to the campaign.

28%

increase in YoY account opens

20%

increase in website traffic