Is Open Banking Taking Place in The U.S. or Not?

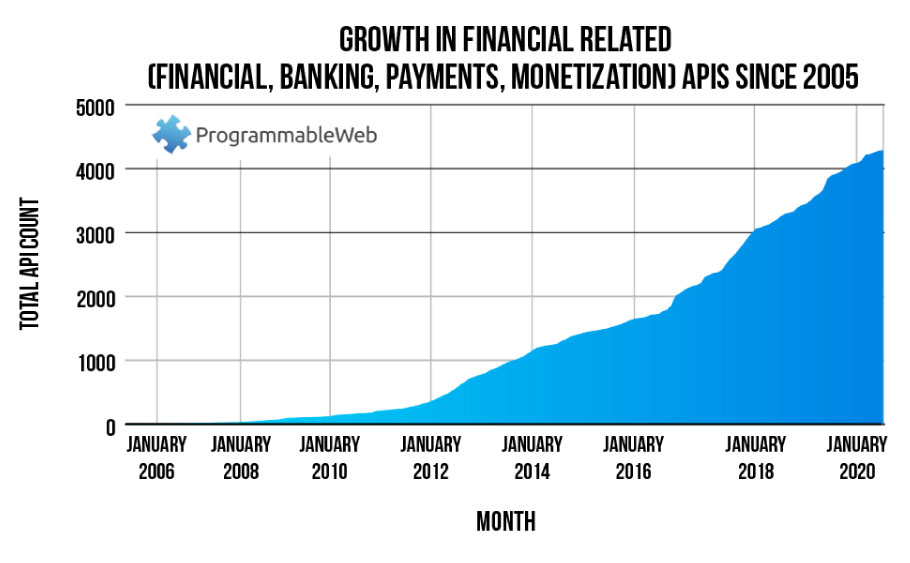

Open banking is oftentimes perceived as a trend taking place in Europe but that is lacking adoption in the United States. The reality is that it is very much a part of the financial services landscape in the U.S., but its proliferation is driven by a different source than in Europe. Due to European regulators predicting a boom in open banking, the EU drafted PSD2 (Payment Services Directive 2) while the U.K. released their version known as OBI (Open Banking Implementation) in order to get in front of the phenomenon with regulations and guidelines. In the United States, the Treasury has agreed to draft guidelines and recommendations, but there is no law or regulation in America that drives open banking forward. However, one doesn’t have to look further than the number of Third-Party Providers (TPPs) affecting consumer and business banking in the U.S. to realize that the trend has taken hold in the states as well. Plaid, which is a TPP that Visa purchased for $5.3 billion, claims that their API interacts with more than 10,000 banks and has processed more than 10 billion transactions. The difference is that it has been a market-driven journey in the U.S., while it was a regulator-driven enactment in the EU and U.K.

Do TPPs Represent a Threat or an Opportunity?

Financial institutions in the United States aren’t likely to stop grappling with this question anytime soon. While there may not be a single answer that we can all agree on, some perspective can be gleaned from Europe, where open banking has been more widely adopted. Regulators in Europe saw open banking as an opportunity for bank customers to benefit from innovations in the tech space but knew that regulation was necessary to keep the train on the rails and to encourage adoption by banks. While many banks initially saw these Third-Party Providers popping up from the fintech space as a competitive threat, many institutions now covet them as not only a new distribution channel but actually as a customer segment in and of themselves.

Open Banking Is All About Innovation, Right?

Anytime this topic is brought up, the conversation naturally focuses on innovation. This is understandable since developments in the fintech space seem to be the catalyst for open banking. However, while innovation may be a primary driver, there are other critical factors at play, including the regulatory environment, digital security, consumer demand and the presence or lack of collaborative spirit existing between TPPs and financial institutions. In order for open banking to thrive, innovation must be balanced out by security, regulation, collaboration and trust. Without these other factors, the potential of innovation is foundationless and potentially disastrous. And just like with building a home, it makes sense to ensure that the foundation is solid before pushing ahead with the next phase. This serves as a partial explanation for open banking not accelerating more quickly in the U.S.

If Customer Experience Is Our North Star, Then Where Is It Pointing?

If you’ve listened to any virtual seminars this year on financial services, then two things must be true: customer experience guides every decision made by every financial institution and everyone has had to pivot, counter-pivot and re-counter-pivot this year. Humor aside, every financial institution is claiming to factor customer experience into every decision they make. If customer experience is the compass, then the arrow may not be holding steady when it comes to this specific topic. On one hand, the market is always showing ever-growing demand for digital solutions that make our lives easier. On the other hand, ask a Chief Experience Officer what their latest NPS data says about their digital convenience tools, and your question will often be met with a gulp. This is because their customers tend to not focus on the breadth or capability of their digital convenience tools but rather on that one time something didn’t work like it was supposed to or that time they had to re-login to the mobile app right as they were almost finished with whatever it was they were trying to complete. It’s a tricky line to walk when you know that your customers want something, but if every kink isn’t worked out ahead of launch, then they’re never going to allow you to live it down.

Where Does Open Banking Go from Here?

Pushing on one side of the pendulum is force in the form of growing customer demand for greater digital innovation. Opposing this force from the other direction is well-intentioned conservativism on the part of the financial industry. After all, most of our nation’s financial disasters have been caused by or contributed to the adoption and implementation of a new financial mechanism outpacing the understanding and regulation of said mechanism. These two diametrically opposed forces have been staging a game of tug-of-war. However, one side received reinforcement in 2020 as the global pandemic artificially accelerated the demand (and need) for digital solutions. Look for a greater level of adoption in the coming months along with a greater commitment on the part of U.S. legislators to install guidelines for the path forward into open banking. As this trend picks up more steam, don’t be surprised when the term shifts from “open banking” to “open finance” as it begins to cast a wider net into more segments of the financial industry.

Questions?

While there is much to weigh and consider, hopefully this article has provided some useful insights into the drivers and barriers of open banking adoption. If you’d like to further the discussion, contact us here or give us a call at 502-499-4209 to get some time on Jonathan Bone’s schedule.

About the Author

Jonathan Bone is Partner and Senior Vice President at PriceWeber. He is the Account Director in charge of PW Financial Services and oversees all work with our Financial Services clients.