Consumer Behavioral Changes During the Pandemic and What Still Lingers Today

The first restaurant I remember going to was the Howard Johnson’s on Route 9 in Framingham, Massachusetts. They had great fried clams and terrific ice cream, and I remember when I was five years old going for the first time with my grandmother. She was a very stern and prim Irish Catholic lady some might call humorless, but we loved her (and feared her a little). This was a special occasion because it was just the two of us having lunch together without the teeming throngs of relatives that a typical Boston family meal implied.

As I finished my scoop of mint chocolate chip ice cream, I noticed my grandma—we called her “Nana”—wrapping up saltine crackers, sugar packets, and salt and pepper shakers in a napkin and placing them in her purse. Not just packets of salt and pepper but the actual salt and pepper shakers.

Lingering behaviors and fears from the Great Depression

Exercising appropriate caution and waiting until we hopped into her Chrysler, I asked her, “Nana, why did you take the salt and pepper from Howard Johnson’s?” She looked at me and blanched, pausing for a moment to find the right words to explain the heist. First, she said, “Well they’re free. Anyone can take them if they want to.” OK, I thought. I mean, I was curious but had the attention span of a goldfish and was ready to move on. But she was still looking at me.

I started to think I was maybe in trouble, but then she said, “What I told you isn’t completely true. You see, when I was a girl, we had something called the Great Depression. We were very poor, and some days we couldn’t afford to eat at all. So, sometimes when I remember those times, I just take things like the crackers and the salt because I remember not having them.” I think because of shame, she never took things from a restaurant in front of me again, and we never talked about the Depression or the saltshaker either, but the experience stayed with me.

In today’s Plain Talk, we’ll dig into some of the long-term implications of consumer behavioral changes during the pandemic and how to adjust to meet them head-on.

- The Effect of the Pandemic on Businesses

- 1. Fear of Handling Cash

- 2. Engaging With Businesses Digitally More Than In-Person

- 3. Choosing Telecare Appointments Over In-Person Health Appointments

- 4. Being Concerned About Crowds

- Some Good News, Please?

- Get Expert Help Understanding Consumer Behavioral Changes During the Pandemic

The Effect of the Pandemic on Businesses

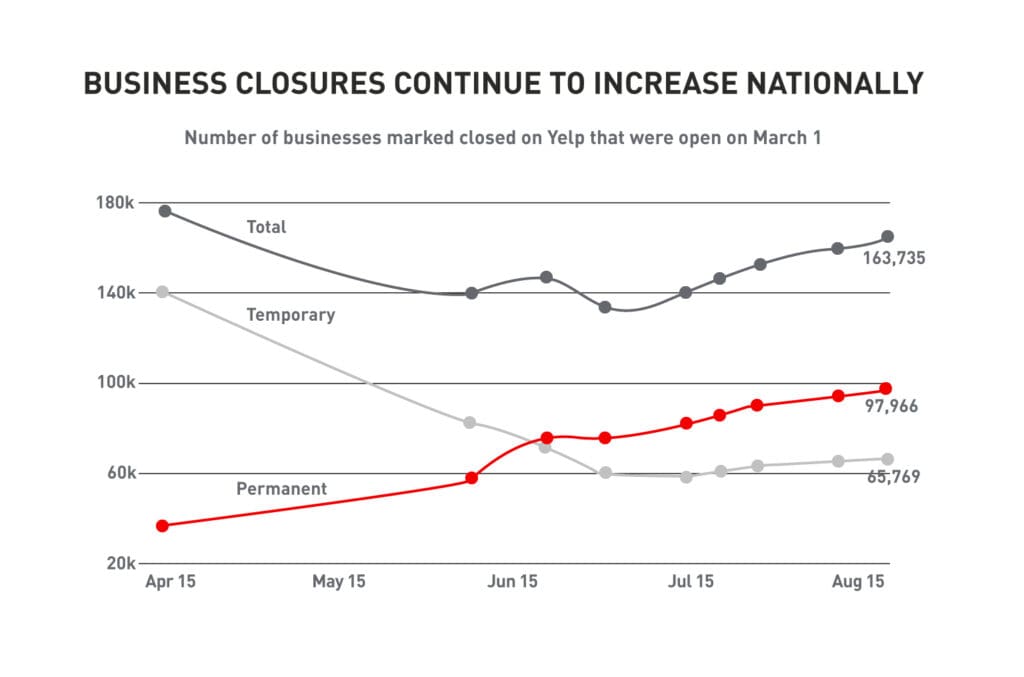

While not as catastrophic in the U.S. as the Depression, the country is emerging from a generation-defining disaster in the form of the COVID-19 pandemic. As of December 2020, the U.S. had 10 million fewer jobs than before the pandemic. According to Yelp, by September 2020, over 97,000 businesses had indicated they closed their doors permanently. Plus, the global media attention to the virus has led to a sharp increase in public fear about germ safety.

While all that seems gloomy, U.S. consumer confidence remains solid, gross domestic product (GDP) is heading in the right direction, and America seems on the way to a sound recovery. While we don’t expect a rash of saltshaker thefts, we do think it’s likely that some behavioral changes sprouting from the past year may remain long after the pandemic is history.

Ongoing Consumer Behavioral Changes From the Pandemic

So, what are some of these changes, and how might those changes impact how you do business?

1. Fear of Handling Cash

Let’s be honest, there are few things Americans are known for more than their absolute reverence of cash. The dollar bill globally represents affluence, freedom, status and security, but if a recent study is correct, more than half of Americans are now uncomfortable with handling cash because of concerns about germs. In fact, the Forrester study indicated:

- 54% of consumers surveyed are concerned about handling paper money/coins as a result of COVID-19.

- 60% plan on using digital/touchless payments instead of cash/coins in the future because of COVID-19

- 5% want to see all coins phased out

- 32% want to see paper money/coins phased out in the future because of COVID-19

Yup, a third of Americans want to eliminate all cash. While trends in mobile payments had been growing for years, the pandemic has accelerated demand for smooth cashless payment experiences. What are some of the marketing implications of our new cash phobia?

Creatively, the image and symbology of cash in creative pop culture are rapidly changing. If people consider coins gross, will “cash back” programs for credit card purchases and other incentives focused on cash continue to resonate with consumers?

Another change to attitudes toward cash relates to customer experience issues like which payment apps can be used to pay your phone bill or buy your cheeseburger. While winners and losers in the touchless payment race are not definite, it’s clear that consumer demand for mobile, touchless options is rapidly increasing. As such, retailers’ banks, point-of-sale (POS) manufacturers and others need to prepare for greater flexibility in the payment options they offer or risk alienating their best customers.

2. Engaging With Businesses Digitally More Than In-Person

Much has already been made of the pandemic driving online behaviors from grocery shopping to doctor appointments to working from home. The changes made by these companies are not seen as short-term stopgaps but as long-term investments. For example, in the healthcare industry, most companies would have told you in 2019 that building a telecare capability was in their business plan for the next five (or 10) years. Then 2020 happened, and virtually every relevant healthcare company hit the gas hard on implementing telecare services.

We saw the same behavior in dozens of disparate industries like furniture and retail banking, where the absence of an in-person option and a vision of the near future where improved digital experiences were expected anyway drove investment in improving digital services and e-commerce offerings. If yours was one of the companies that invested in upping your digital experience game, there’s a new risk. What if people go back to previous (non-digital) behaviors?

While trends seem to indicate that is unlikely in many verticals, the smart play in the coming year will be to maximize that investment by reinforcing your customer’s choice to engage digitally, even as they emerge from pandemic lockdowns.

3. Choosing Telecare Appointments Over In-Person Health Appointments

Virtual healthcare or telecare, as previously mentioned, received a significant amount of investment in 2020. Telecare helped hospitals and doctor’s offices continue to see patients while minimizing the risk of COVID-19 transmission. It all accommodates challenges like closed schools and daycares that might have kept some patients from being able to visit their doctor.

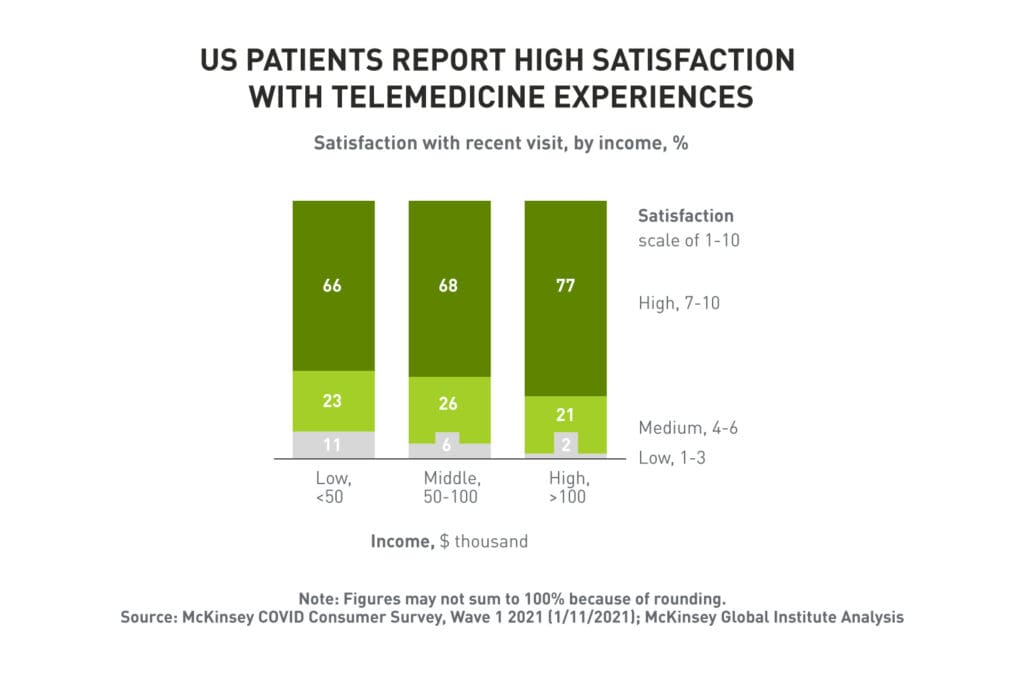

In speaking to some providers, we understand that the rush to push out a useable telecare solution fast meant cutting some corners on experience. However, a recent McKinsey study showed shockingly high levels of satisfaction with the telecare experience. Even more interesting was that the level of satisfaction was fairly consistent regardless of the patient’s income level.

The combination of ongoing germ phobia and positive consumer experiences suggests that we need to rethink healthcare interactions in the next decade. From urgent care to primary care physician (PCP) offices, we must ramp up to meet these evolving expectations. And there are a ton of extant best practices out there to glean from. Digital UX and CX best practices and trends in consumer online behavior can be applied to the online healthcare experience. In addition, clinics and physicians deploying telecare services need to think about the opportunity to build their online reputations (think reviews) as well. For example, if your telecare appointment doesn’t end with offering your patient the opportunity to rate their experience, you are missing out.

4. Being Concerned About Crowds

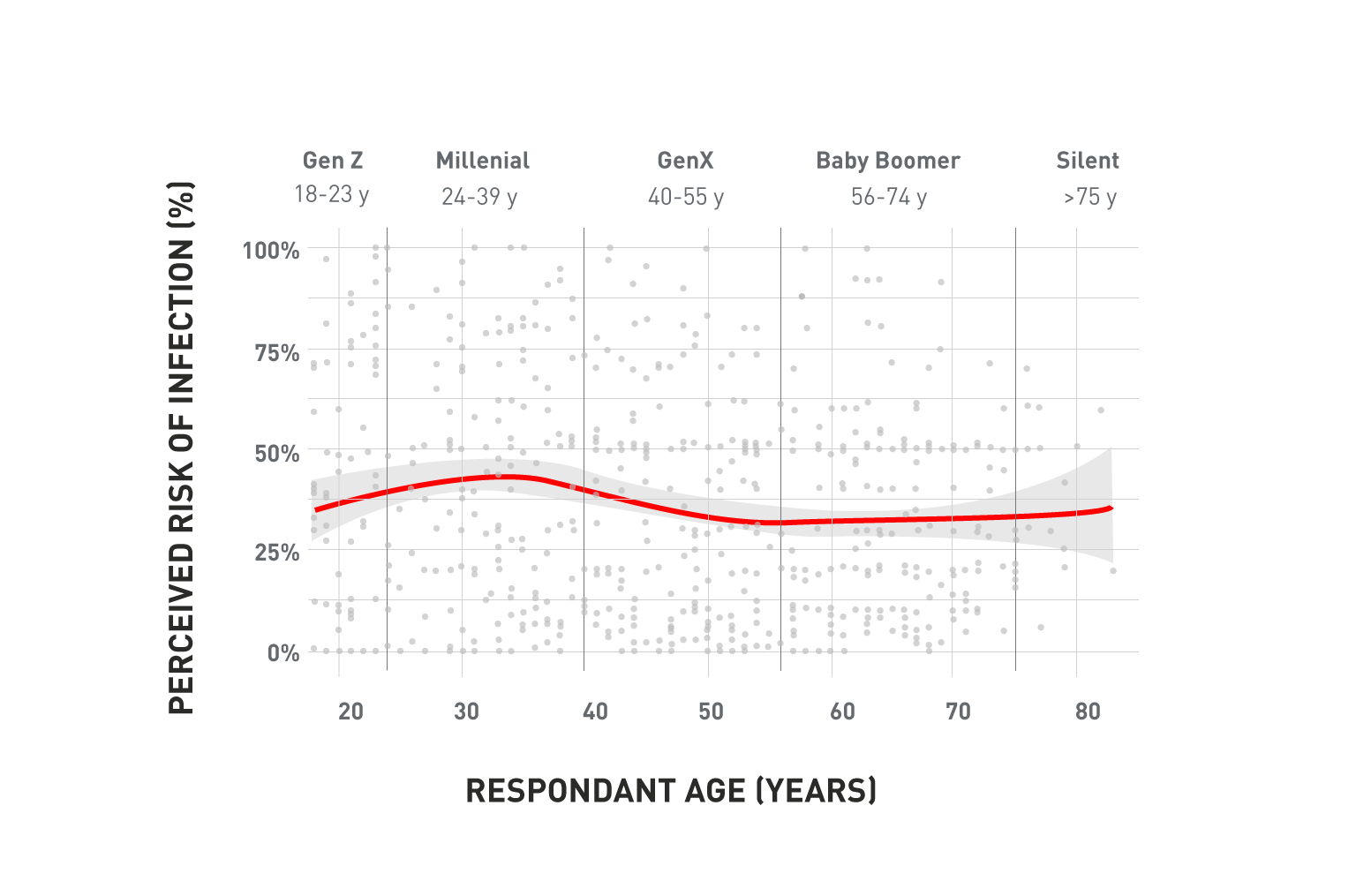

The necessity of aggressive adoption of online activities, like the ones above, has come at the cost of human interaction. The watercooler at work is a lot quieter. Use of public transportation has dropped significantly, sporting events are empty or sparsely populated, there are no more tailgates. With the exception of some spring breaks, crowds of the non-socially distanced are still pretty rare. But that’s not to say that people don’t look at social distancing and crowds differently. While unmasked college students on spring break made headlines, no place was reporting record crowds. It’s likely a mistake to think that this attitude towards crowds and masks is strictly generational. In fact, a University of South Carolina study indicates that age (generation) is not a significant predictor of whether someone will practice social distancing for fear of infection.

This means that regardless of your target consumer demographics, there is a segment that is likely concerned about or turned off by crowds and a segment that is not. What we don’t know yet is whether concerns about crowds (much like people being grossed out by cash) will have a residual effect beyond the pandemic. This can and should impact how your brand thinks about, plans and tests ad creative that includes people, and should warn you against letting your own bias on the topic drive creative decisions. This is especially true when considering digital creative where versioning options are more flexible and testing conversion against different target groups can be set up pretty easily.

Some Good News, Please?

While it’s important to consider the potential negative impacts of consumer behavioral changes during the pandemic, don’t lose hope. That news comes in two parts. First, as we mentioned earlier, the forecast for the U.S. economy in 2021 is to grow at a heart-racing 6.2% versus -2.3% in 2020. That is in spite of restrictions holding back some businesses right up until today.

Second, Americans are more flush with cash than they have been in a long time. In 2017, the personal savings rate was close to a record low. By summer 2019, 40% of Americans reported that they would struggle to come up with $400 for an emergency expense. But the combination of fear of the unknown with generous unemployment benefits and direct payment stimulus dollars led to record savings rates unseen since World War II.

With consumers flush with cash and consumer confidence on the rise, the race is on for brands to prepare for and lay claim to their share of this bonanza. Yet with a tough 2020, many fiscally conservative brands do not have marketing plans that have prepared them for this opportunity. But it’s not too late.

Get Expert Help Understanding Consumer Behavioral Changes During the Pandemic

We’re constantly assessing consumer behavioral changes during the pandemic and their impact on your business today. Please continue to check back here periodically for the latest. If you have any questions about the trends unfolding above, give us a call at 502-499-4209. Or, drop us a note here and we’ll be happy to chat with you.

Our Articles Delivered

Signup to receive our latest articles right in your inbox.