SEO for Financial Services: 10 Key Considerations

“It takes as much energy to wish as it does to plan.” While this sentiment, credited to Eleanor Roosevelt, is often expressed when discussing finances, I like to think the same can be said for financial services SEO. From investment strategies and risk management to services for individuals, businesses, nonprofits, and governments—money and finances touch every aspect of life. If you’re a retail, commercial, or investment bank, credit union, savings and loan association, brokerage firm, or insurance or mortgage company, your website needs to be optimized for organic search. If you know this but don’t know where to start, read on.

In this edition of Plain Talk, we will address things to consider before implementing SEO for financial services.

- Achieve Internal Stakeholder Alignment

- Set Clear Goals

- Understand Your Target Audience and Their Search Intent

- Conduct Comprehensive Keyword Research

- Ensure Compliance and Data Privacy

- Consider All Four Pillars of SEO

- Develop Helpful Content and Link-Building Strategies

- Review Google’s E-E-A-T Principle

- Understand Google’s YMYL (You Money or Your Life) Guidelines

- Utilize Local SEO Strategies for Branch Visibility

- Get Expert Help with SEO for Financial Services

1. Achieve Internal Stakeholder Alignment

Getting everyone within your company on the same page before implementing SEO strategies is an important first step. You need buy-in from everyone in order for search engine optimization efforts to succeed and produce ROI. To do this, different teams like customer experience, marketing, IT, and compliance need to work together. Here’s how each department’s roles contribute to SEO.

- Customer experience: Customer experience teams understand what customers want and what makes them do the things they do. As is the case with most financial service firm functions, building a strategy around customer perspectives is a great place to start.

- Marketing: Marketing understands your positioning in the marketplace, what products/services are important to push and how to communicate with your target audiences most effectively. This helps you make good decisions around keywords and content.

- IT: The IT department contributes its technical expertise to optimize website structure, page load speeds, and mobile responsiveness—key elements for SEO success.

- Compliance: The compliance team ensures that all content and strategies adhere to industry regulations and standards, safeguarding the company’s reputation and legal position.

When these departments collaborate, financial services can establish a robust online presence. Streamlining the implementation process means catering effectively to user intent and ultimately achieving a competitive edge in the digital realm.

2. Set Clear Goals

Next, you’ll want to define clear objectives for your company’s SEO. These goals provide a focused roadmap for everyone, aligning efforts toward achieving specific outcomes. Some typical areas finance companies may want to focus on improving are:

1. Website traffic: Boosting organic traffic aims to attract a larger and more engaged audience. Doing this increases the chances of turning visitors into customers and encouraging more interactions.

2. Lead generation: Improving lead generation recognizes the importance of attracting and nurturing potential clients. Implement content marketing and user pathways that are strategically optimized to guide potential clients to conversions effectively.

3. Brand awareness: The desire to enhance brand visibility indicates the intention to establish a strong and recognizable online presence. This positions your financial institution as a dependable and authoritative source in its specialized field.

By clearly outlining these objectives from the start, you can lay the groundwork for an effective SEO campaign and fortify your digital marketing strategy efforts.

3. Understand Your Target Audience and Their Search Intent

Gaining a deep understanding of your target audience and their intent is a pivotal step for financial service companies as they ready themselves for SEO implementation. By analyzing the specific needs, preferences, and behaviors of your audience, you can tailor your SEO strategies to cater effectively to customers. Exploring the financial topics and queries that resonate with your target demographic ensures that the content produced aligns precisely with what potential customers are seeking.

This audience-centric approach not only enhances the relevance and value of the content presented but also positions you as a reliable and knowledgeable source within the online financial services industry realm. By deciphering the intricacies of your audience’s intent, your company can optimize its digital presence, create meaningful connections, and ultimately foster stronger engagement and trust with your customer base.

4. Conduct Comprehensive Keyword Research

Smart keyword research helps financial services focus on what’s most important for their business goals. Think like your customers and thoroughly research the search terms they might use when they’re searching for financial solutions like yours. Remember that people go online mainly for two reasons: to get information or to buy something. Use specific keywords that match your products and services, like “mortgage loans” or “online banking.”

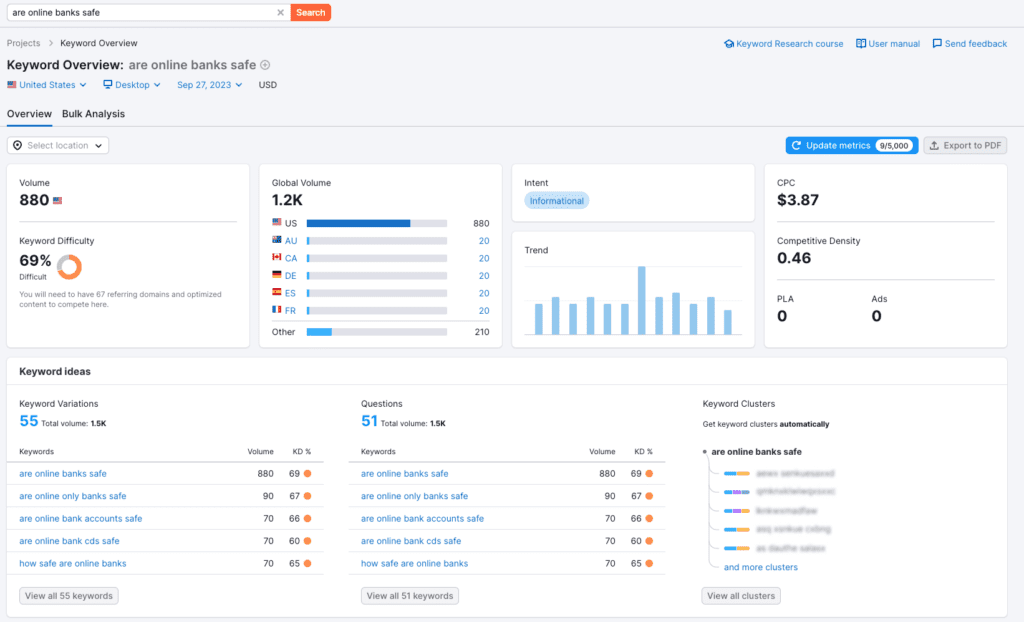

But don’t stop there. Up your ranking factor by researching financial question keyphrases (also known as long-tail keywords) people are asking and provide the answers with content on your website. Examples related to the keywords above might include “What is a reverse mortgage loan?” or “Are online banks safe?” Both of these have a search volume of over 800 searches every month! That means there are over 800 opportunities to get the attention of people who are actively looking for your type of financial services and products.

There are several tools available that provide in-depth keyword research information, including Semrush, Ahrefs, Moz, and SpyFu. You can also look to free Google products like Keyword Planner, Trends, and Search Console for ideas. Even just typing a keyword into the search bar can turn up all kinds of results thanks to features like Autocomplete and People Also Ask.

5. Ensure Compliance and Data Privacy

When it comes to financial services websites and fintech, following the SEC, FINRA, and related authorities isn’t just a legal requirement; it’s an integral aspect of proper SEO. This means openly and accurately sharing financial advice, product details, and potential risks. Balancing effective content optimization with meticulous regulatory compliance safeguards a company’s reputation, legality, and user trust.

The importance of data privacy and security on financial websites is also linked with effective SEO practices. Safeguarding customer information isn’t just morally right—it’s legally mandated. Incorporating data privacy measures, such as encryption and secure authentication protocols, shields clients from potential threats and fortifies a website’s credibility and reliability—critical factors that search engines consider in their ranking algorithms.

Adhere to established guidelines

Adhering to established guidelines such as GDPR (General Data Protection Regulation) and CCPA (California Consumer Privacy Act) is important as well. These regulations delineate the collection, processing, and storage of user data, giving individuals control over their personal information.

By harmonizing data privacy and security with technical SEO efforts, your financial website can create an effective cycle: building user confidence, satisfying regulatory demands, and ultimately bolstering online visibility and trustworthiness in the eyes of both consumers and search engines.

6. Consider All Four Pillars of SEO

There’s a lot more to ranking in organic search results than sprinkling a few keywords into some copy, installing Yoast on your website, and hoping for the best. A good SEO agency knows how to work with you to develop the right strategy for your financial services marketing goals based on these four elements.

Technical SEO

Technical SEO addresses a website’s underlying structure and code to enhance its visibility and performance. Conducting a comprehensive SEO audit is an important first step in identifying and addressing technical issues. Additionally, implementing schema markup in your website’s code can provide search engines with structured data about financial products and services. This makes it easier for them to understand and display relevant information in search results.

On-page SEO

This is the optimization of various elements within a web page to improve its search engine visibility and rankings. The process includes strategically using keywords in title tags, meta descriptions, and headings – as well as utilizing internal linking – to make content more relevant to search queries.

Content and User Experience

High-quality, relevant content not only attracts and engages users but also provides valuable information that crawlers favor when determining search rankings. A positive user experience, which includes factors like page load speed, mobile-friendliness, and easy navigation, ensures that visitors stay longer on a website, reducing bounce rates and improving overall engagement metrics. If you already have a lot of content on your website, but it wasn’t written with SEO in mind, content tuning to existing pages and articles can make a positive impact without requiring volumes of new content to be developed.

Off-page SEO

Off-page SEO involves optimizing factors outside of a website to boost its online authority and search engine ranking. Key elements include building quality backlinks, leveraging social media platforms, and obtaining online citations, such as in financial services directories.

7. Develop Helpful Content and Link Building Strategies

Your website may be a digital work of art, but what are web crawlers finding when they get there? If you want to rank high on search engine results pages (SERPs), you have to provide both people and search engines with what they’re looking for. That’s why developing high-quality financial content is another consideration for financial services. It’s a cornerstone for effective digital engagement. Consider the following types of content when developing your content strategy and calendar.

- Educational articles covering various financial topics provide valuable insights and guidance to users, positioning financial institutions as authoritative sources of information and fostering user trust.

- How-to guides for financial services offer step-by-step instructions, empowering users to navigate complex processes with confidence, thereby enhancing their overall experience.

- Customer success stories and testimonials showcase real-life examples of individuals benefiting from financial services, highlighting the practical impact of the offerings and building a relatable connection with potential customers.

While thinking about content creation, consider how link-building strategies can factor in as well. When credible and trusted sites link to your company’s content (a practice known as backlinking), it signals to search engines that your company is regarded as an authoritative source. You can read more about the importance of authority in the next section.

8. Review Google’s E-E-A-T Principle

Google’s E-E-A-T guidelines, which stand for Experience, Expertise, Authoritativeness, and Trustworthiness, play a pivotal role in influencing search engine rankings by evaluating the quality and credibility of online content. In the financial sector, users seek content that is accurate, backed by expert knowledge, and comes from sources with a strong track record of reliability. Here’s a brief overview of each component and how you can tie it into your financial services SEO efforts:

Experience

Using an in-house subject matter expert (SME) to check and greenlight content is a smart way to showcase experience in the financial services field. When content is reviewed by an industry specialist on your team, it’s a clear signal to both searchers and search engines that the information can be trusted. By linking the reviewed content to your SME’s online bio or profile, you amplify their credibility and expertise. This approach not only bolsters the E in E-E-A-T but also increases your site’s reputation as a solid source of financial insights and advice.

Expertise

Demonstrating the Expertise component of Google’s E-E-A-T guidelines demands a strategic approach that bolsters your company’s credibility and industry leadership. Showcasing professional credentials like licenses, certifications, and affiliations with respected organizations underscores the competence of your financial experts.

Additionally, the creation of content that’s informative, insightful, and accurate takes center stage. Offering comprehensive analysis, unraveling complex financial concepts, and providing practical advice highlight the company’s depth of knowledge. Position your company as a dependable information source in the digital arena and amplify your authority and influence.

Authoritativeness

Your financial services website becoming a recognized authority in the field requires consistent efforts. Here are some ways to bolster your company’s credibility, voice, and reputation in the industry. As these activities accumulate, your business will gain a reputation as a go-to source of reliable information. This also aligns well with Google’s Authority criteria.

- Share original insights and offer unique perspectives

- Conduct thorough research and publish findings

- Engage in public speaking

- Contribute to respected industry publications

- Participate in discussions within the financial community

- Guest blog in financial and banking niches

- Build relationships with other authoritative financial websites

- Create shareable and link-worthy content to acquire backlinks

Trustworthiness

Fostering trust through transparent communication is probably the most important aspect of E-E-A-T. Providing clear and accurate information about things like services, products, and the financial advisors who are providing advice instills confidence and trust in users and search engines alike. For example, be sure your content addresses potential risks and limitations openly while offering solutions and alternatives. Sharing client testimonials, case studies, and success stories can also showcase your company’s trustworthiness and positive impact on others.

9. Understand Google’s YMYL (Your Money or Your Life) and Its Implications for Financial Websites

Google’s YMYL (Your Money or Your Life) concept relates to web content that can significantly affect users’ financial, health, or safety decisions. This content requires heightened credibility and accuracy. In the financial services sector, YMYL content holds the power to shape crucial decisions such as investments, loans, and financial planning, which can deeply impact a person’s financial well-being. Google places a strong emphasis on making sure that what’s shared on YMYL pages is secure, dependable, and trustworthy.

Financial service providers adhering to these principles can boost their online presence while providing accurate and credible information to users seeking guidance on significant financial matters. To adhere to YMYL guidelines, it’s essential to steer clear of sensationalism and misleading claims. Striking a balanced and informative tone helps build trust, and avoiding exaggerated language or unrealistic promises prevents potential misguidance.

10. Utilize Local SEO Strategies for Branch Visibility

Finally, does your company have several locations? By strategically harnessing local SEO techniques, you can cultivate a robust online presence for your branches in different cities or states. This establishes a strong connection with the local community and drives foot traffic to your physical locations.

- Location pages: Dedicated location pages allow financial institutions to target specific geographic regions. They also tailor content to meet the unique needs and interests of local customers. By including location-specific keywords, relevant information, and contact details, businesses can increase their visibility in local search results.

- Google Business Profile: Create and optimize Google Business Profile (formerly Google My Business) listings. Add accurate and detailed information about branch locations. This includes pertinent details like address, phone number, and business hours. Consistency in NAP (Name, Address, Phone) information across all online platforms further reinforces the legitimacy of the branch.

- Reviews: Effective management of online reviews and ratings is another important aspect of boosting local SEO. Positive feedback boosts branch credibility and encourages user engagement. Conversely, addressing and resolving negative reviews promptly demonstrates a commitment to customer satisfaction.

Get Expert Help with SEO for Financial Services

The success of implementing SEO for financial services requires considering several different factors. From compliance and keyword optimization to content relevance and adapting to evolving search algorithms, there’s a lot to navigate. Need some help? Send us a message or give us a call at (502) 499-4209.

If you’re not already a subscriber to our Plain Talk newsletter, you can subscribe below.

Our Articles Delivered

Signup to receive our latest articles right in your inbox.