Customer Retention Strategies for Banks: A 2025 Playbook for Bank & Credit Union Marketers

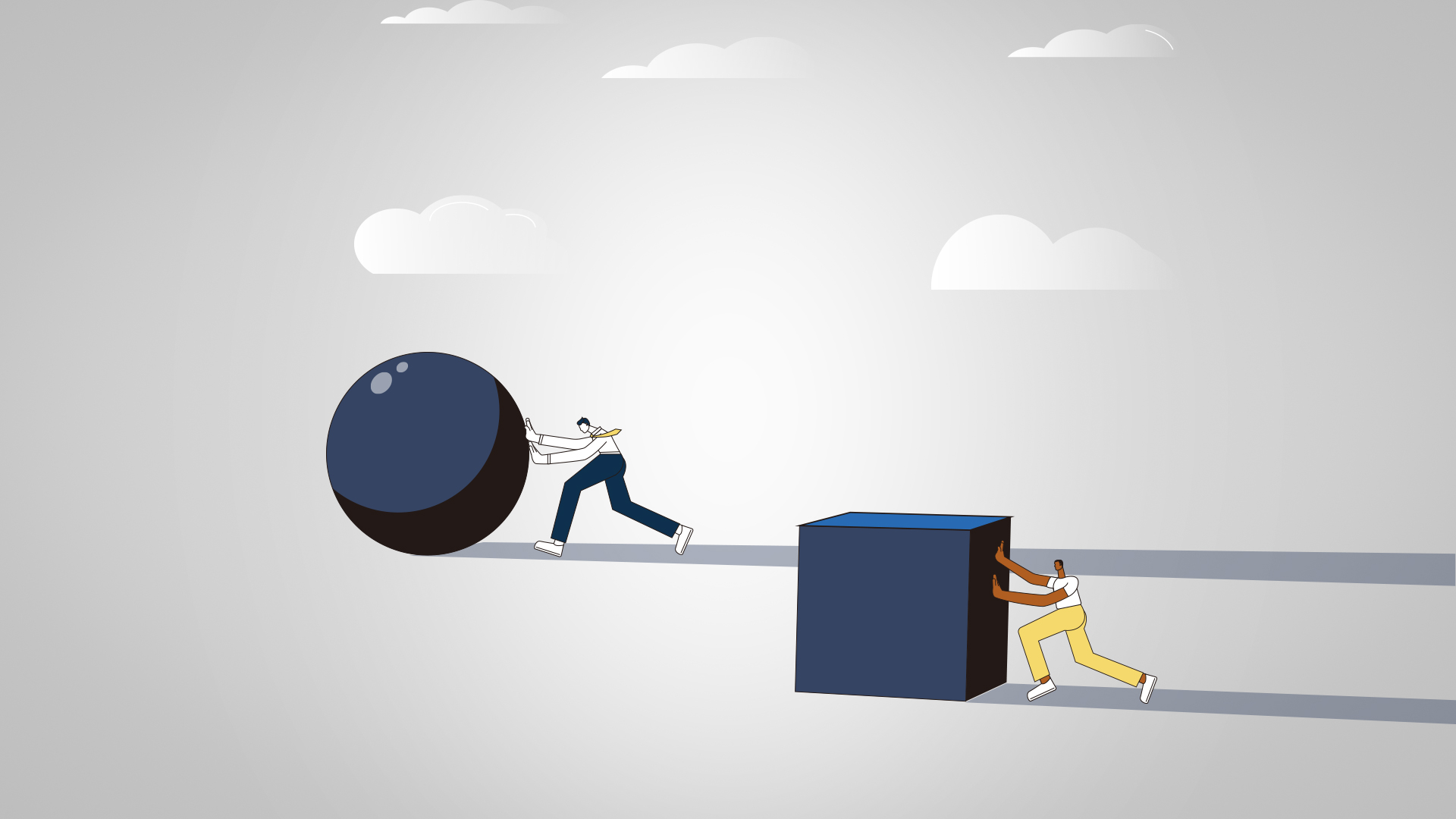

Customer retention is more critical than ever for banks and credit unions, especially as acquiring new clients can cost significantly more than keeping existing ones. With 13% of retail banking customers likely to switch within two years and ongoing marketing challenges, financial institutions must take a strategic approach. This playbook outlines five proven customer retention strategies for banks to boost engagement, reduce churn, and increase customer lifetime value.