Why Aren’t Bank Marketing Budgets Budging?

In October 2022, as bankers were facing some uncertainty about what 2023 would look like, Steve Cocheo at The Financial Brand and Gartner’s Jason McNellis shared a great POV about bank marketing budgets and the critical role marketing plays in bank growth. They talked about the need to be “surgical” when considering possible budget cuts and how important it was not to fall into the trap of just hacking off budgets by the percentage point. By all accounts, it looked like most banks were following their lead with modest growth predicted in marketing spend across the industry.

Then in March 2023, Silicon Valley Bank and Signature Bank got clobbered, giving Wall Street the jitters and sending the press into a frenzy. Given this frenzy, we were curious if U.S. banks were cracking under the pressure of the 24-hour news cycle, so we sent out a simple one-question survey to bank CEOs across the country. “Will your 2023 bank marketing be less, about the same, or more than in 2022?” To our surprise, not a single bank that responded said that their budgets would be lower than those in 2022. Not one.

In this edition of Compound Interest, we’ll touch on some quick tips for bank marketing budgets. We’ll also discuss why banks are not flinching and how smart marketing might be just the ticket for banks looking to grow in 2023 and beyond.

- 3 Reasons Banks Can Feel Good in 2003

- 3 Strategies for 2023 Bank Marketing Budgets

- Get Expert Help With Allocating Your Bank Marketing Budget

3 Reasons Banks Can Feel Good in 2023

1. First, the sky did NOT fall.

Immediately after the fall of SVB, Moody’s announced a foreboding investigation into the soundness of the American banking system while looking into possibly downgrading six banks, including First Republic Bank, Zions, Western Alliance, Comerica, UMB Financial, and Intrust Financial. At this writing (and keep in mind all of these banks are smaller than SVB), only First Republic has seen a change of status with Moody’s.

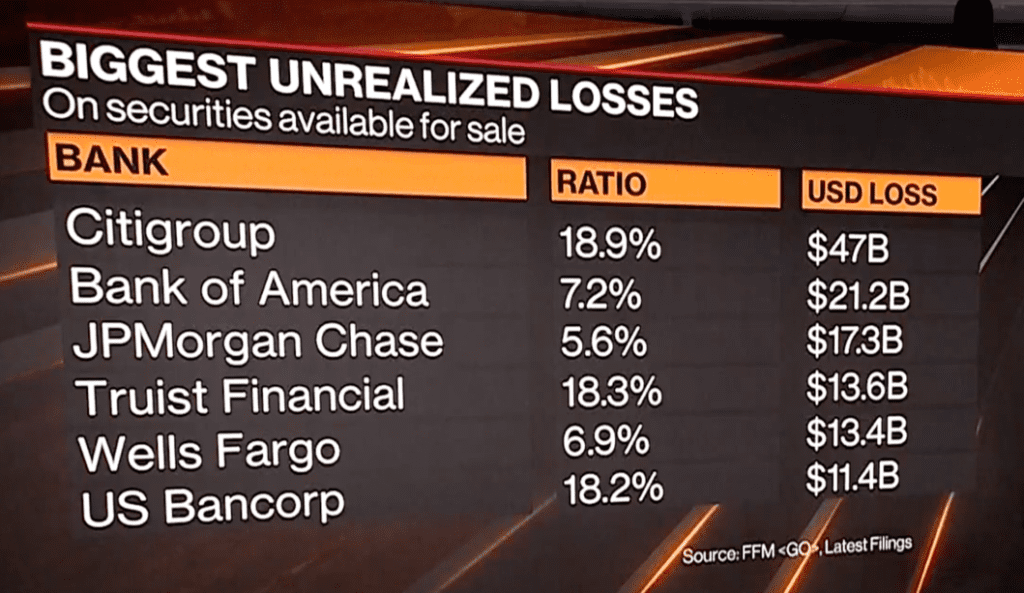

Meanwhile, the largest banks in the country, the ones with the lion’s share of unrealized losses, are in pretty solid financial condition when considering loss-to-equity ratios. And most banks with assets over $5 billion are also in good shape in this key area.

2. Uncle Sam stands ready to act decisively.

Regardless of how one feels about politics and bailouts, there is a measure of comfort in the lengths the Fed is willing to go to maintain order and stability in banking—and that’s not just in the U.S. Both Credit Suisse and HSBC show that banking and government in other countries stand ready to work together to intervene and maintain stability. The two things markets dislike the most are instability and uncertainty. These recent actions indicate that we can feel pretty confident that the banking sector is safe and open for business.

3. You aren’t SVB or Signature.

While there are market fundamentals worth watching in times of change, it seems highly unlikely that you, the reader, are in the same situation as SVB. In fact, it could be argued that even SVB wasn’t in an unsalvageable position (we wrote about that in mid-March). So, what will you do with this freshly minted optimism, and why are banks staying the course on marketing spend?

3 Strategies for 2023 Bank Marketing Budgets

While your team looks at fundamentals like asset quality, it’s time to activate and empower your marketing team too. A year like 2023 creates opportunities for smart banks to improve their position in the market, assets under management, and long-term profitability. It’s a marathon, not a sprint. So, what can marketing be doing to strengthen your position?

1. Cultivate trust

Trust IS currency. Banking is a high-trust business in good times and bad. Unfortunately, if you don’t work to cultivate trust in both, the evaporation of trust in tough times can leave you vulnerable. Ask SVB. The emotional response to low trust is what leads to depositor panic. If your bank has been focused on depositor promotions at the expense of brand advertising, it’s time to rebalance your marketing mix. We’re not saying don’t do promotions (see below!), but we are saying that PR, brand advertising, meaningful community activity, and a reliable, human customer experience are more likely to build that currency for when you need it. Let’s be honest; nobody is ever going to make a run on USAA.

2. Do your promotions

Henry Ford was once famously quoted as saying, “A man who stops advertising to save money is like a man who stops a clock to save time.” If you are counting on your competitors to lay low, you’ll be in for an unpleasant surprise. Inflation has eaten into some depositor accounts, so rather than holding off, smart banks should be seeking to use promotions to improve market share from banks who imprudently stop marketing, bring in new depositors from the MASSIVE generation that is Gen Z, and promote underutilized high-margin services like personal banking, wealth, and trust services (if you have them). This doesn’t have to mean some big, expensive TV campaign either. Talk to your marketing team and agency about affordable options with high ROI like:

- Improved SEO for product and promotional landing pages

- Highly targeted paid search

- Financial literacy and life-stage content (e.g., parents are the number one influencers of where their kids will bank)

- Email and other direct marketing

- Tight geo-targeting (bank radius)

- PR and community activism

- Social media and improved review generation and management

If you are a regional bank, think about the old joke about outrunning a bear. You don’t have to outrun the bear; you just have to outrun the other guy. Remember, you cannot save your way to growth.

3. Invest in experience

So much of the conversation about bank marketing over the last 10 years has been about digital. We get it, we are heavily digitally focused ourselves, but your customer experience (CX) goes way beyond your website. Customer experience is a chain made of the sum total effect of every customer or prospect touchpoint and is only as good as its weakest link. That weak link manifests as a customer bouncing from your site, choosing to get a loan at a different institution, a bad review or a closed account. If you have not done a customer experience audit in the past 3-5 years, you may be behind. Look at:

- Branch comfort, flow, signage, staff training, and drive-thru. Would YOU like to spend 30 minutes in your branch? Put yourself on the other side of the desk, counter, or drive-thru window.

- Website experience. Where are people coming from? Paid? Organic? Social? Where are they going? Are they bouncing? Why? What do site metrics like time on site and conversion rates for different traffic types tell you?

- Media experience. Are you running one-size-fits-all creative but expecting everyone to react the same to it? People don’t work that way. Should you consider creative versioning to make your messages work better? Multivariant testing? Is your balance right between brand and promotion?

- Reviews and social engagement. How do your customers feel about you when they are satisfied? Dissatisfied? How responsive are you? How visible is that responsiveness? Is your social just about selling, or does it demonstrate your value?

CX audits are best done by independent outside organizations that will give you the straight scoop and may be the shortest line between investment and improved conversion rates for all promotions and revenue-generating activities.

Get Expert Help With Allocating Your Bank Marketing Budget

Flat marketing budgets don’t have to mean stagnant growth if you know where to spend them. If you’d like to chat about where your institution’s opportunities lie or how an experience tune-up could supercharge your results, drop us a note here or call 502-499-4209 and we’ll be happy to help.

Our Articles Delivered

Signup to receive our latest articles right in your inbox.