If you’ve been in the banking business for a while like me, you can attest to the fact that for decades, pundits have declared virtually every recession, economic downturn or national crisis to be the death knell of community banks, and in 2020, the financial emergency caused by the global pandemic is no different. We all understand that this challenge is extremely serious and that yes, some community banks may not make it through in their current form. However, I believe it’s the unique features and inherent value of the community banking model that will be at the core of the coming economic recovery. In today’s edition of our “Compound Interest” series, we’ll look at why community banks and credit unions are crucial to the coming turnaround and what your institution can do to thrive under tough conditions.

Why the gloom?

Much of the current conversation and conventional wisdom in financial discussions is about how under current “lock down” conditions, larger and more digitally focused banks are better suited to weather the storm and serve the shelter-in-place population. Furthermore, that banks who do not have a strong digital platform may not survive the challenges we all face. We agree that a strong digital service offering is important for banks to continue to meet the service expectations of a changing population. If you’ve been putting off upgrading your digital services, keep an eye out for an upcoming Compound Interest article about upgrading efficiently. Until then, where should your focus be and what advantages should you rely on as a community bank?

Reach and Access

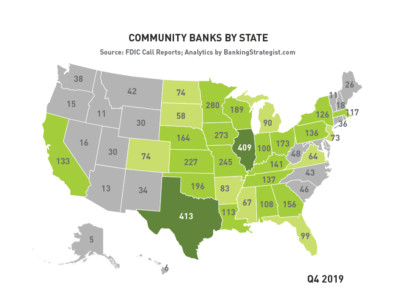

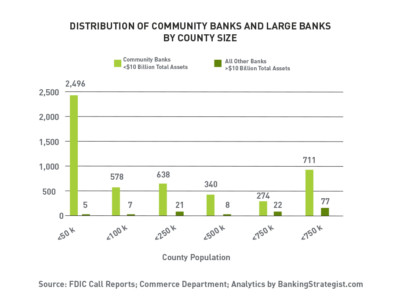

One factor in measuring the importance of community banks is simply geographic reach and the diversity of that reach. While the majority of banking dollars are processed through the top five banks, community banks and credit unions make up the vast majority of actual institutions, and they extend their reach far more deeply into geographies that the biggest banks do not serve effectively or well.

Community banks and credit unions may offer the most reliable access to banking services throughout much of the country during this crisis, and remaining available to customers during any crisis is central to the mission of a community bank.

If you are like most community banks, you’ve already made adjustments to your operations by closing branch lobby services (except by appointment) and shifted focus to drive-through, ATM/ITM or other remote services. If possible, another way to “be there” is to extend call center operations (or any form of phone service) to allow more employees, including those working from home, to be accessible by phone.

Providing responsive personal service and access to information and resources based on the real needs of the community and not based on a centralized, prescribed script are advantages that will be remembered by customers long after the crisis ends.

Leverage Your Flexibility

Access to credit is always a priority during trying times. Whether establishing personal lines of credit, different access to home equity or providing mortgage relief, local banks can distinguish themselves to their retail customers by being genuinely flexible, accessible and responsive to their needs.

Small businesses are particularly affected by the pandemic. Whether working to manage cash flow through operating lines of credit or renegotiating loan covenants and terms, business customers understand and appreciate the value of working with banks who know their business directly and have the ability to act accordingly. Moreover, it’s this very local understanding of the businesses in your community that provides you with both a competitive advantage in lending and the opportunity to play a significant role in your community’s recovery.

Regional and community banks still operate based on the original principals of credit – the 4 c’s – character, capacity, capital and conditions. It’s significant that the first “c” is character. This means that the bank knows the owners, understands their character and factors that into their decisions. This isn’t possible with larger, money-center banks who tend to focus on sanitized credit reports, cash flow analysis and prior lending history in making decisions. Local banks also consider these factors but are also able to evaluate a client’s situation based on more than just the math. Whether extending a line of credit based on inventory or receivables, temporarily lifting certain terms and conditions or simply talking through alternatives, flexibility based on “conditions” is a critical aspect of what community banks uniquely offer.

Local banks will continue to serve customers in the community because it is your community. Your business depends on the health and vitality of businesses and families in your community, where larger, national banks are evaluating their franchise differently and may not understand the resources needed.

Now more than ever, community and truly regional banks are able to “out-local the nationals,” but the big banks’ ability to “out-national the locals” is limited. This means that the value of community has never been more important.

Be Visible

Most banks have long ago published a statement on their website, social media and email about their response to Covid-19. Their well wishes to customers, changes to branch hours or operations, dedication to the safety of their workers. Those boxes are all checked. But the pandemic and the impact on families and businesses will be with us for a while. As the initial shock wears off, your customers will be looking for solutions to their personal and business financial needs. That’s why it’s important that your institution is purposely visible.

CRM – If you don’t already use a CRM system for email marketing, now is an excellent time to start. There are excellent and very affordable options out there like MailChimp or HubSpot that virtually anybody can learn to use in just a few hours. Whether your CRM is new or you’ve worked with one for a while, now is the right time to get busy with email.

Most consumers today report that email is their preferred method for receiving communication from companies, and as we’ve already stated, your customers will be looking for solutions. After breaking your customer email list into segments (businesses, younger/older customers, mortgage or consumer loan customers, etc.), it’s time to start delivering solutions directly to their email. Regardless of the solutions you offer, your customers will want to know that you stand at the ready to help them in tough times.

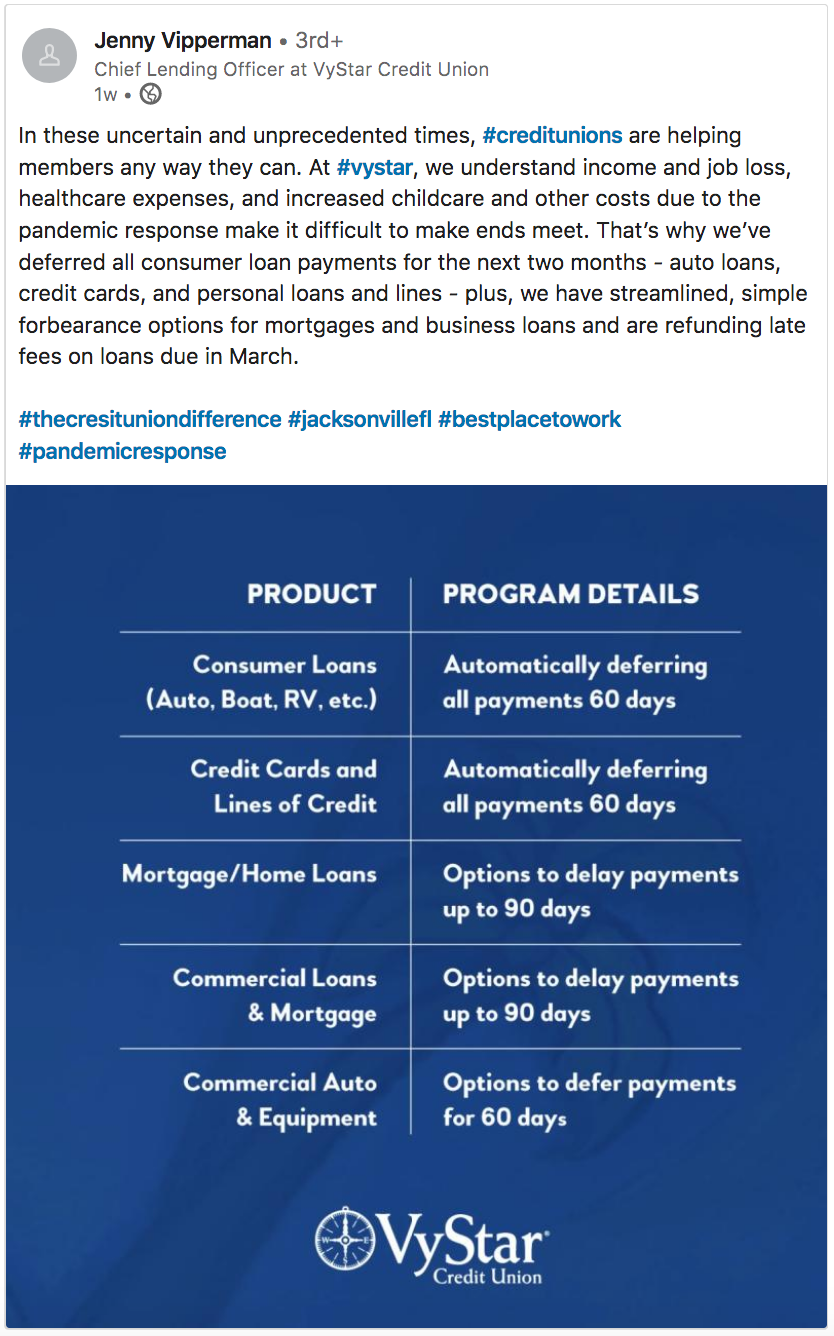

Social Media – Social media may not be the best way to connect directly with your customers, but it is a superior channel for conveying your commitment to them and the community and for communicating steps that you are taking to address the crisis on a daily basis. Remember that today there’s a social media channel for every audience and that every constituent of yours is listening.

(Facebook post, VyStar Credit Union, March 2020)

PR – If you don’t have a PR expert in-house or an agency partner, there will never be a better time than right now to forge that relationship. Your PR partner will help you work with your local media to convey important news, changes and solutions that your bank is introducing to customers and non-customers alike.

Partner – As a bank you have special knowledge and skills that can be especially important during difficult economic times. Can you help set up a charitable trust for restaurant workers? Do you have clients that you could partner with that are actively engaged in some community problem-solving related to the crisis? If these circumstances exist, you should consider participating or organizing now. Every action you take as a leader in your community during this (or any crisis) will serve to further cement your place as essential to your community. Wherever you decide to put your energy, be sure to leverage your email and PR resources to invite and engage customers to participate with you.

Advertising – If you have an advertising budget and regularly run paid media, the message is especially important today. Most community banks focus their ad dollars specifically on product advertising. During this crisis, the value of paid media may be more about communicating your commitment, conveying details of the steps you are taking to support the community and detailing the options available to consumers and businesses through your institution.

Be quick

While each of these approaches can be useful in securing your institution’s position in your community while creating opportunities for growth, it’s important to understand that the speed of your ongoing responsiveness matters. One challenge that often hampers community banks is antiquated or slow decision-making processes. During the pandemic and its fallout, consider agreeing with internal stakeholders (and board members) that an abbreviated workflow and decision process should be implemented to get ideas to your customers quickly.

If you have questions about how to improve your workflow during this crisis or need assistance in performing a marketing audit on your bank, please consider contacting us here or calling 502-499-4209.