Effectively targeting and attracting Generation Z depositors must be a key component of bank marketing plans in the mid- and long-term in order to replace the current boomer customer base as these consumers transition to drawing down assets in retirement. In this edition of our Compound Interest series, we’ll help break down critical experiences, characteristics and drivers for Generation Z that impact how they will make decisions about financial services.

Who is Gen Z?

Generally speaking, Gen Z is anyone from the third grade to recent college graduates whose early lives were defined by the Great Recession but were too young to recall the events of September 11th, 2001. Gen Z is less likely to drop out of high school and more likely to be enrolled in college, driven in part by second-generation members of the Hispanic community whose parents have emphasized the importance of a college education on future economic prospects and the generation generally growing up in slightly more affluent circumstances than previous generations.

Unlike the millennial cohort who came of age during the Great Recession, Gen Z was expected to inherit a strong economy with record-low unemployment. The sudden arrival of COVID-19 has disproportionately impacted Gen Z families and dashed some of these optimistic economic prospects. Nearly 50% of older Gen Zers reported that they or someone in their household had lost a job or taken a pay cut as a result of the coronavirus pandemic. Additionally, younger workers are overrepresented in high-risk service-sector industries. As a result of in-progress educational attainment, Gen Z is less likely to be working in their teen and young adult years than previous generations.

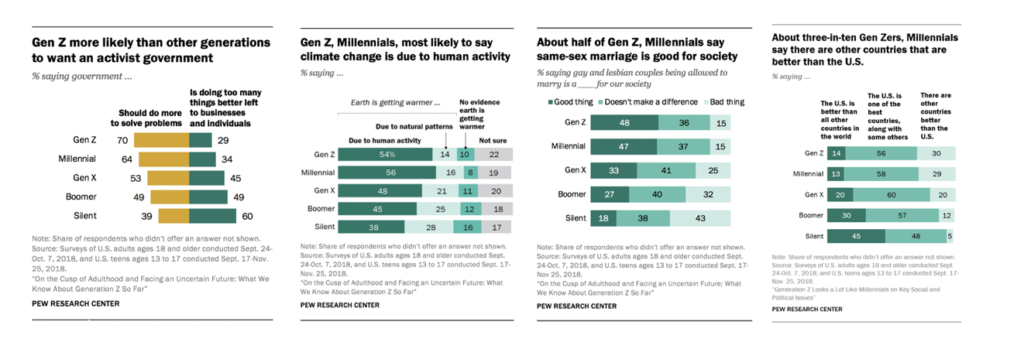

From a political standpoint, Gen Z is more likely than older generations to look to government to solve problems rather than businesses or individuals. Seven in ten Gen Z members say that government should do more to solve problems like climate change, systemic racism, same-sex marriage and other issues. Members of Gen Z are also more likely than their generational counterparts to disagree with the statement, “The United States is the best country in the world.”

Demographically, Gen Z represents the leading edge of the country’s changing racial and ethnic makeup (52% of Generation Z is non-Hispanic white and 1 in 4 Gen Zers are Hispanic.) Members of this generation are less likely to be immigrants to the United States but more likely to be children of immigrants than the millennial cohort (22% have at least one immigrant parent.) As is already the case on the west coast and in metro areas, Gen Z is projected to become majority non-white in 2026 due to continued immigration.

Finally, members of Generation Z are tied to their phones to a degree not previously seen. The iPhone launched when the oldest member of Gen Z was 10, meaning that Gen Z has surpassed the millennial “digital natives” to be the first “mobile natives.” Staggering adoption rates like 95% access to a smartphone and 97% usage of one of seven major online platforms are evident in the generation that reports being online “almost constantly.” Gen Z assumes constant connectivity and on-demand entertainment (some 90% of Gen Z report playing video games.) Some recent research has suggested that this significant “screen time” is contributing to rates of anxiety and depression.

These demographic and online usage trends point to four key focus areas for financial services marketers.

ONE: Financial prudence is the new normal for Gen Z

Having seen their parents or slightly older millennial cohorts face financial challenges, Gen Z has responded by saving more, thinking through purchase decisions, and avoiding credit mistakes millennials made (particularly with student loan balances). Some 70% of Gen Zers monitor finances on a daily basis.

Implication:

Financial services brands have a clear opportunity to help Gen Z “get to where they want to go” by providing educational resources to help younger consumers learn and perfect budgeting and expense management through simple and direct messaging and video content.

TWO: Seamless mobile experience is key

Members of Gen Z are comparing financial services mobile apps to every other app across all categories on their phones, including mobile-first fintech firms. Frictionless connectivity is the basic expectation among Gen Z, necessitating navigable content served appropriately across multiple touchpoints with an emphasis on video and micro content. Established firms, community banks, and credit unions alike must be able to compete on home screens and in these contexts.

Implication:

Financial services firms must effortlessly fit into the lives of Gen Z. Legacy technology systems are no longer an excuse – action must be taken to modernize IT systems and enable the delivery of perfect digital touchpoints and on-demand customer utilities.

THREE: The Great Recession and residual impact damaged trust

Only 34% of Gen Z and millennials trust banks. Generation Z is more vigilant and suspicious of the financial services category as a result of fallout from the Great Recession, leading them to consider new entrants and category disruptors that they perceive to be more authentic and trustworthy.

Implication:

Financial services brands must clarify their purpose and pursue that purpose from within their organizations, beginning with their employees. From a positioning and messaging standpoint, legacy firms must emphasize these actions and work to emulate startups and category disruptors.

FOUR: Key role of social media and influencers

Unlike millennials and previous generations, mobile phones are the windows through which members of Gen Z see the world. Social media specifically is where this generation is exposed to new products and services, and also where it gets its news.

Implication:

Financial services brands should engage influencers and prioritize social-based advertising channels to tell their brand story and walk through convenience products. Further, an opportunity exists to utilize existing CRM programs to encourage parents in their 40s to open accounts for their children. This parent audience is far more likely to recognize the value of financial responsibility early in life.

By starting out with a clear understanding of the factors driving Generation Z decisions, savvy banks and credit unions will get a head start on the competition and cultivate trusting, long-term relationships with them. We believe this is a smart long-game strategy that will deliver ROI for decades to come.

To learn more about Gen Z and banking, or if you have any questions about this or other articles we’ve produced, please call us at (502) 499-4209 or contact us here to schedule an appointment.

About the Author

David Lowe is our Director of Strategy and Consumer Insights at PW Financial Services Marketing. His focus is on developing an ever-deepening understanding of what drives key consumer segments to action. David combines his insatiable curiosity about people and the world with his ability to bounce between large-scale strategy and minute detail to produce actionable strategies for clients in our financial services practice.