What is Silent Switching?

Silent switching, also referred to as silent attrition and silent churn, is when customers of a bank fragment their banking activities by using secondary institutions for financial services offered by their primary institution. This growing phenomenon is tough to detect because the customer doesn’t close their account at their main institution, so unlike when a customer moves their account from one primary bank to another, the losses incurred from silent switching are more gradual and frequently fly under the radar.

Why are More Bank Customers Fragmenting Their Financial Relationships Than Before?

There are multiple reasons for this, but the single largest factor is how our financial system has evolved with the rise of neobanks. A neobank is a fintech firm that offers the ability to make various financial activities highly convenient through online apps, software, and other technologies. Neobanks don’t have physical locations but instead compete based on better rates, lower fees, and online convenience.

According to Statista, in 1997, total transactions through neobanks in the U.S. accounted for $97.8 billion worth of total transaction value. By 2022, that figure grew over 10X to more than $1 trillion. Statista forecasts an annual growth rate for the next four years of 16.12%, which would predict $2.6 trillion worth of transactions through neobanks by 2027. Many of the largest neobanks have become well-known names in the industry. Based on the study from Statista, the largest neobank in the world is Nubank, which is based in Brazil, while the largest North American neobank is Chime.

The rise of neobanks has dovetailed with decreasing Net-Promoter Scores (NPS) for traditional banks and was accelerated by the disruptions of the global pandemic, which forced citizens to carry out more activities online than they had in the past. While in-person bank branch visits have rebounded since the pandemic, customers’ expectations for digital experience were forever changed.

What Customer Segments Are Affected by Silent Switching?

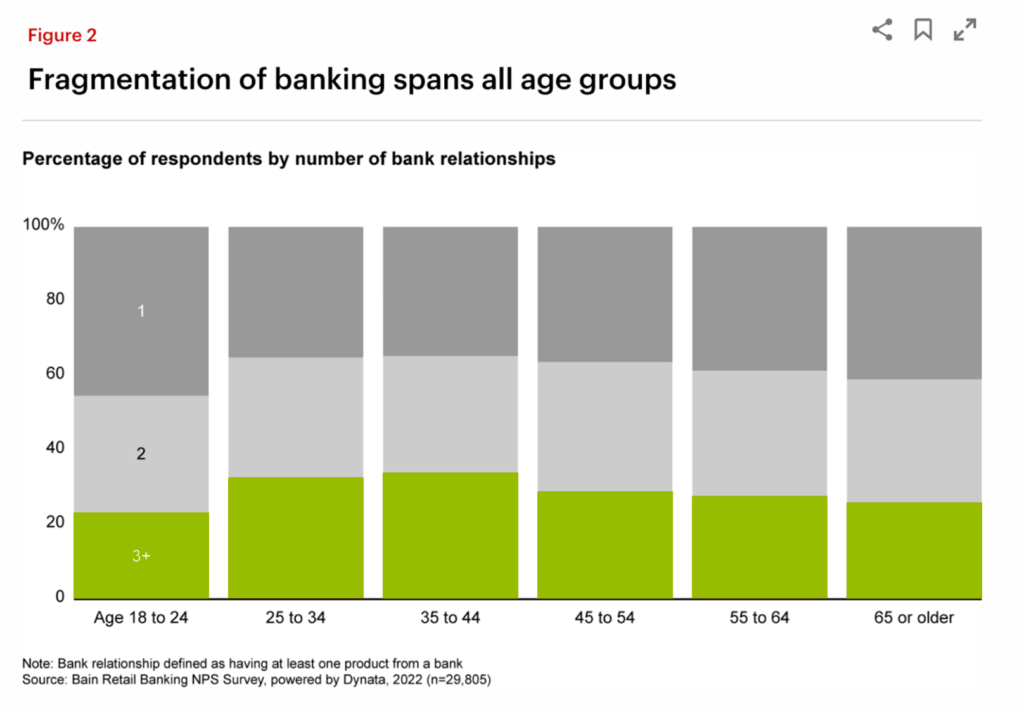

It would be easy to assume that this trend is more prominent with younger generations since they don’t have as long-standing of relationships with their main financial institution and are likely to value digital experience more than their older counterparts. However, the data paints a very different picture. Per the below graphic, based on a study from Bain Retail Banking, the age bracket that’s by far the most likely to have exactly one financial services provider is 18-24. That may not be surprising given where they are in their financial journey, but what is surprising is that there’s very little difference in terms of the percentage of respondents with one financial institution across all other age brackets in the study.

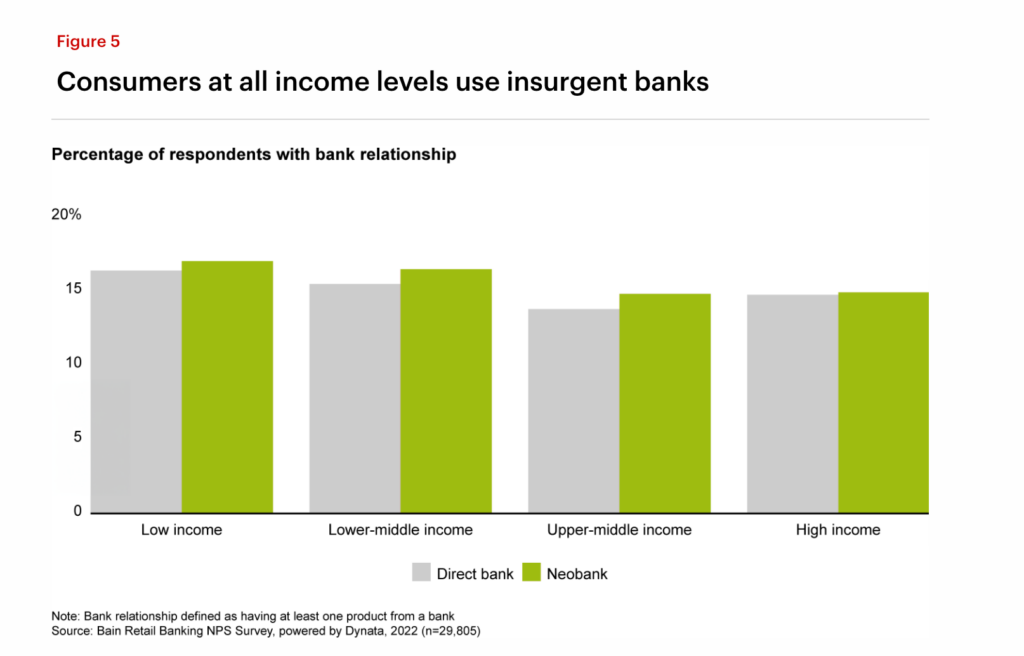

There’s, of course, more to consider here than just age, though. The chart below displays relationships with direct banks and neobanks by income level. Across each income bracket listed, the percentage of respondents that have a relationship with a neobank only shifts by a couple of percentage points, indicating that income level has little to no bearing on fintech adoption.

What Can Primary Banks Do to Combat This?

1.) Good Advice and Guidance

There’s no replacement for being a trusted advisor to your clients. Consistently offering knowledgeable guidance at touchpoints that are in the client’s best interest builds trust and loyalty. While this begins at the one-to-one personal level, reaping the full benefit of your expertise in doing this extends beyond these direct communications. Savvy financial institutions do a great job of displaying their capabilities in this arena by taking it online in the form of digital self-help resources they make available to customers as well as prospective ones. Another great tactic is to compile customer testimonials of clients who have benefitted from your guidance. These can be written or in video form. Smart use of such digital assets helps curate more new account relationships that start with the expectation of an advisory relationship versus viewing your service as a commodity. This is how you make new accounts see you as more than an interest rate.

2.) Strong Digital Experience

No, digital experience isn’t the only reason people use a neobank. But trying to beat them purely on rates and fees isn’t a winning strategy. The next best line of defense is to offer a comparable digital experience. This means intuitive, convenient, consistent, and secure.

- Intuitive: Users shouldn’t need to review documentation, spend time clicking around aimlessly, or converse with a chatbot to carry out basic digital banking activities. When evaluating the intuitiveness of your digital experience, it’s important to extend your analysis to any off-domain experiences you offer through 3rd-party partnerships.

- Convenient: Convenience is the very reason customers demand digital banking tools in the first place. They need to be able to access their funds whether they’re at home, in the office, or traveling. Ensuring that most users can carry out the activity they set out to accomplish in the channel they started in is critical. The second they must jump from their computer to their phone and back again can be all it takes for them to lose their patience.

- Consistent: This one is severalfold. First off, whether a user is on a desktop computer or mobile device, they should be able to enjoy a good experience that’s not drastically different based on their advice. Secondly, regardless of whether they’re on your website, in your mobile app, or receiving an email from you, it should all look and feel similar. They shouldn’t be asking themselves, “Is this really my bank, or is this a scam?”

- Secure: The importance of preventing cybersecurity breaches as a financial institution goes without saying. But this is about more than just addressing your vulnerabilities. It also gives people peace of mind all the time. Communications that display the lengths you go to in order to keep customers’ finances safe can go a long way. The other side of the fence is arming your customers with the knowledge needed to make sure they’re doing their part as well. Blog posts and other resources you make available that provide tips on identifying scams and phishing attempts help display how seriously your institution takes risk management against fraud. The rise in fraud we’ve witnessed in recent years, paired with lingering unrest from the Silicon Valley Bank collapse, has made many consumers more conscientious than ever about the security of their financial assets.

3.) Personalize the Experience

For most users of financial services, we’ve moved past a time when they worried about how much of their data their bank has and into a place where it’s expected. But with that expectation comes the expectation that it will be used in a way that benefits the customer as well. At a minimum, this means tailoring your cross-selling activities to the customer’s financial behaviors. Ideally, it also means tailoring their self-serve digital experience as well. Smarter use of customer data is a mutually beneficial activity for the institution and the customer. From your perspective, it helps improve customer loyalty and the hit rate of cross-selling tactics and can help you head off silent switching based on your customers’ financial behavior indicators. For your customers, you’re making their experience more efficient, not inundating them with off-target promotional messages, and providing more tailored advice.

4.) Loyalty Reward Programs

Loyalty reward programs can offer a lot of creative ways to prevent silent switching while also building customer loyalty. It’s important to think beyond deposit balance for reward programs. Consider rewarding customers with incentives for interactions rather than making your reward methodology only about dollars. Criteria such as the number of times a customer uses their debit card or the number of times they log in to their online banking account during the month, regardless of transaction totals, can be an effective way to keep them engaged from a usage perspective and displays that you value them for more than just their account balance.

5.) Keep Filling The Bucket From The Top

While the above-mentioned tactics can help primary banks decrease the impact of silent switching, it’s completely unrealistic to expect to stop it entirely. This is an area where effective marketing can make a big difference by helping to add new accounts to offset losses. Having a strong promotion plan, a targeted paid media spend and an impactful organic search strategy can make all the difference. It’s imperative that these elements work in combination with one another as well as with your other channels within your communications ecosystem, such as social media. From early-stage consideration to an online presence during the phase when a potential customer is doing their research on rates and making sure the right person sees your promotional rate at the right time, it frequently takes several key touch points before acquiring a new depositor account. Having the right plan in place, tracking key metrics, and optimizing as you go are critical to driving new bank accounts.

Need Help Keeping Or Growing Your Deposits Base?

There are many marketing disciplines that factor into this equation, including customer relationship management, paid media, public relations, social media, SEO, and more. It’s a lot to juggle, especially if you’re trying to make significant progress in the short term, so having a marketing partner with expertise in all these areas as they apply to financial services can be a big help. If this is what your business could use, drop us a note or give us a call today at (502) 499-4209.