Does Gen Z spend their tax refunds differently than older taxpayers? The simple answer is, yes! Is now the time to talk about how tax refund season can fit into your marketing plans? Also, yes! After all, you know the old saying “in this world nothing is certain, except death and taxes.” So in this edition of Plain Talk, we’ll discuss how Gen Z spends (or pre-spends) their tax refunds differently from Millennials and other Americans. We’ll also discuss whether you should target their refund and how to best align and market your products or services to them during their annual influx of cash.

Topics Covered:

- The Growing Importance of Gen Z

- Gen Zers manage their money well!

- How they plan to spend their tax refund

- How Gen Zers actually spend their returns

- Aligning products and services for Gen Z tax refund dollars

The growing importance of Gen Z

People born between 1997 and 2012 (Gen Z) are expected to account for about 27 percent of the workforce by 2025. According to TurboTax, 91.3% of Gen Z tax filers received a refund in tax year 2021. In 2019, Gen Z’s average tax refund was $3,386 which was over $400 more than any other age group still in the workforce! So while people under 26 contribute less than 1% of tax revenue, the Government works like a piggy bank for Gen Z by giving them about $3,000 back each year. With 31.3m people age 18-24 in this country, there is approximately $106 billion flowing back into the hands of Gen Z in the form of refunds each tax season.

While Gen Z continues to grow in size as more and more age up into the workforce, the group’s earnings are climbing as well. TurboTax reported in their survey of the first half of 2022, which was published in April 2023 that 63.29% of Gen Z reported adjusted gross income increases of over 10% year over year!

Gen Z manages their money well!

Despite being 26 years old or younger, Gen Z manages their finances extremely well. In a recent survey of Gen Z’ers born before 2004, 69.1% are currently feeding a savings account. And within that group, 56.4% are putting money away for their first home.

They are also extremely industrious. 52% of Gen Z has a side hustle and 39% report making more than $600per year from their side hustle. For this generation, side hustles seem to further feed that government piggy bank leading to larger IRS tax refunds.

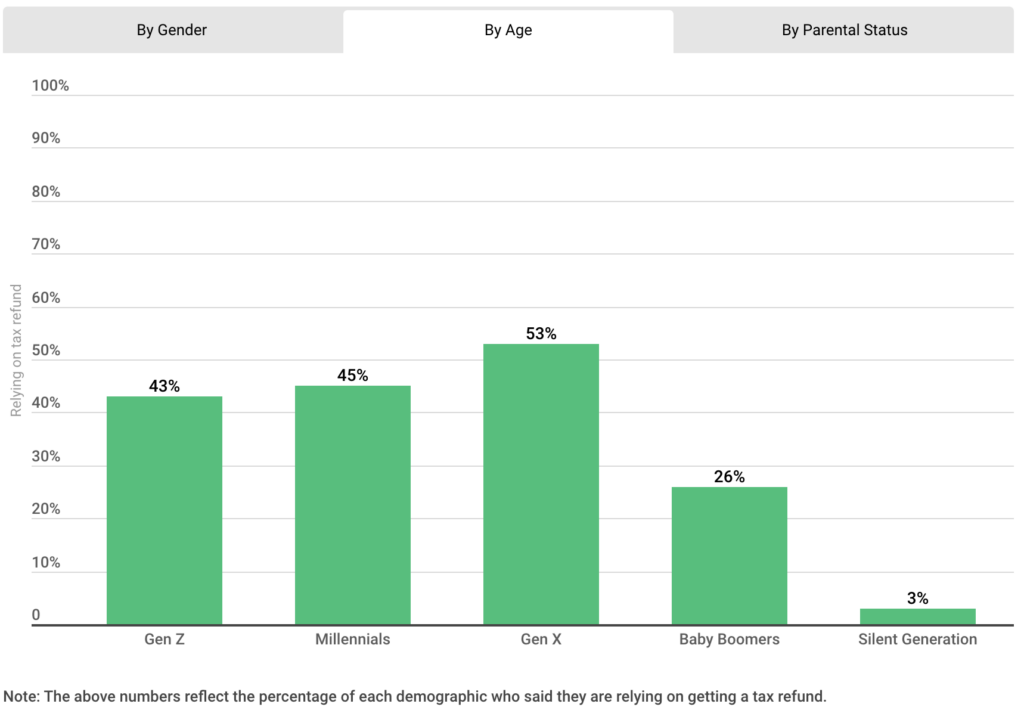

Unsurprisingly, Gen Z also reports few major expenses. Approximatley 58% live with their parents, and many remain on their parents’ health insurance; being allowed to do so until the age of 26. Because of this they are less likely to report relying on their tax refunds for important expenses when compared to other Americans. This means that for many of them, their $3,000+ tax return in Q1 is potentially disposable income, and that could be an opportunity for your brand.

How Gen Z plans to spend their tax returns

How people plan to spend their money and how they actually spend it are often times very different! Sometimes, they have noble intentions. A recent GOBankingRates survey found that one third of Gen Z aged 18-24 planned to put refund money into a savings account (33%), followed by using it to pay bills (19%) and pay off debt (15%). But in a similar 2023 survey when H&R Block asked Gen Z specifically if they plan to use all or some of their return to treat themselves, 91% confirmed they did intend to treat themselves. So, it is likely that while most plan to be responsible, they don’t plan to be responsible with the whole refund!

How Gen Z actually spends their returns

Let’s look deeper into how 34% claim to be paying a debt or bill, conforms to the statistic that 91% plan to treat themselves. Jackson Hewitt reported recently that 63% of Gen Z 18-21 year-olds were using their tax refund to pay-off debt they incurred during a vacation! So, they were both paying bills or a debt AND treating themselves! They were doing so by vacationing on credit and anticipating paying the travel debt or bill back once they got their refund.

According to TurboTax, 55% of people under 34 report splurging on unnecessary purchases, and 47% of them report to spend their tax refund in ways for which they did not plan. Which could be great news for large-ticket marketers with the right message and timing.

And while Gen Z has 86% less spending power than Boomers did at the same age, they are willing to spend more on experiences. They express less interest in spending on expensive cars and houses.

When determining what Gen Z will actually spend their tax refunds on, given that many pre-spend it, maybe it’s best to look at what else they confess to deficit spending on: 37% deficit spend on clothing; 34% furniture; 28% vacations; 25% home remodeling; 21% electronics; 15% debt consolidation; 13% gifts.

With all this buying on credit in advance of tax season, it makes sense to consider a marketing plan timed to take advantage of this pre-refund shopping occasion.

Aligning products and services for Gen Z tax refund dollars

How to approach this consumer and shopping occasion will vary by your category but here are a few examples from a few categories we cover of how companies might target Gen Z refunds:

Law Firms

With 52% of Gen Z Americans having side-hustles, law firms might target them to use their tax refunds to do the paperwork necessary to incorporate. Estate planning for young families could also target refunds.

New Year, New You! January is also the most popular month for people to contact a divorce attorney. $3,000 would help to cover a retainer. If you practice divorce law, some strategic search engine marketing (SEO) and paid search might make sense.

Higher Education

While a tax refund is hardly enough for a degree, it is enough for a person to achieve a valuable on-line certification as a project manager (PMP), Google Professional Cloud Architect, an Insurance Agent, or a host of other professions. Degree-providing institutions can use this opportunity to lead with certifications and establish relationships with new students, they can later convert to their degree programs. For example, a University might lead with a Certificate in Cyber Security that also offers Associates and Bachelor’s degrees in the same subject. A survey conducted by LinkedIn in 2021 reported that over 86% of Generation Z have enrolled in online courses to build hard and soft skills.

Beverage

There are only a few years of data on how Gen Z consumes alcohol as their oldest members are only 26, but directionally, there seems to be differences in preferences from previous generations:

“While its members aren’t drinking as much due to reasons including increased health conscientiousness or a desire to protect their image on social media (think “drunk posting”), they are taking a “quality over quantity” approach when they do decide to drink.”

Gen Z desires authenticity and can see through nonsense. They are driving all of the growth in luxury goods. Additionally, many of their childhood games and toys are now proving to have collectable value, driving them to participate in collectables. It is safe to assume that these three factors may lead them to participate in collectable bourbons and high-end liquors as they gain more disposable income.

Some minimal effort to target them before tax season may prove successful.

Healthcare

While Lasik is approved for people over 18, most LASIK eye surgeons agree on 25-40 as the ideal age range for LASIK eye surgery. So Lasik and other elective surgeries – mostly cosmetic can start targeting older Gen Z members in Q1. A plastic surgeon might target them with discounted skin peels and then use the opportunity introduce them to more expensive procedures when they have or are expecting their refund.

Financial Services

Financial service institutions need to sell Gen Z on their products and services well before they receive their refund. Remember while 33% plan to save their refund, those responsible decisions often are subverted by the need for sandy beaches or a new PlayStation.

Plus almost 1/3 of Gen Z who files taxes use a software like TurboTax. When people use a tax software, they are prompted first with putting money into a Roth IRA.. So, if you’re a small or medium-sized bank and you’re going to want them to invest in a financial product or service, you need to both sell them on the service and why the service is best purchased through you – as opposed to some big institutional TurboTax partner.

While you may not be ready to start posting short videos to #TaxTok, you’ll do well to have a plan to reach Gen Z early and often.

Nonprofits

Gen Z has been described as the most charitable generation. For their age, their contributions to nonprofits eclipse those of previous generations. More than 1/2 of Gen Z donated money to a charitable organization in 2021 with (53%) of Gen Z donors including charitable donations in their monthly budget. Further, 39% actually made sacrifices in their discretionary spending in order to have funds to donate to the nonprofits they felt were compelling. Sixty percent of donors give to new causes when they see a pressing need in the news or in response to a timely appeal from an organization, cause, or individual. 57% research an organization thoroughly and most give online.

Some things to consider when approaching Gen Z during pre-tax season include:

- Be as specific as possible about what you are asking help to fund.

- Have a robust website experience with easy ways to make a donation.

- Promote actively on social media and create shareable content for donors.

- Seek amounts that are “age-realistic” donations

- 88% of Gen Z uses a payment app like Venmo so consider connecting your PayPal Charity account to Venmo to allow for easy donations.

Travel

This year, college Spring Break kicks off in late February and it will be “fire!” Plans are best made and deposits are placed 4-6 months in advance. That means students will be planning and reserving as early as September and October. Time your campaigns to remind pre-breakers that their tax refund will be coming just in time to pay off their vacation.

63% of Gen Z planned to travel in 2023. 43% of Gen Z plans to travel solo or with friends this Spring Break. Consider offering for small deposits or a payment plan. AirBnB’s payment plan option is a gamer-changer feature that is proving how Gen Z seems more comfortable with not paying all at once.

So now is not too soon

Now is not too soon to start thinking about Gen Z and their Q1 tax refund windfall. If you want to chat about how YOUR business might benefit from this $106 billion opportunity, drop us a note or call us at 502-499-4209.

Like what you read today? If you’re not already a subscriber to our Plain Talk newsletter, you can subscribe below.